FCPO - SMA Lines Give Way

rhboskres

Publish date: Fri, 26 Oct 2018, 04:32 PM

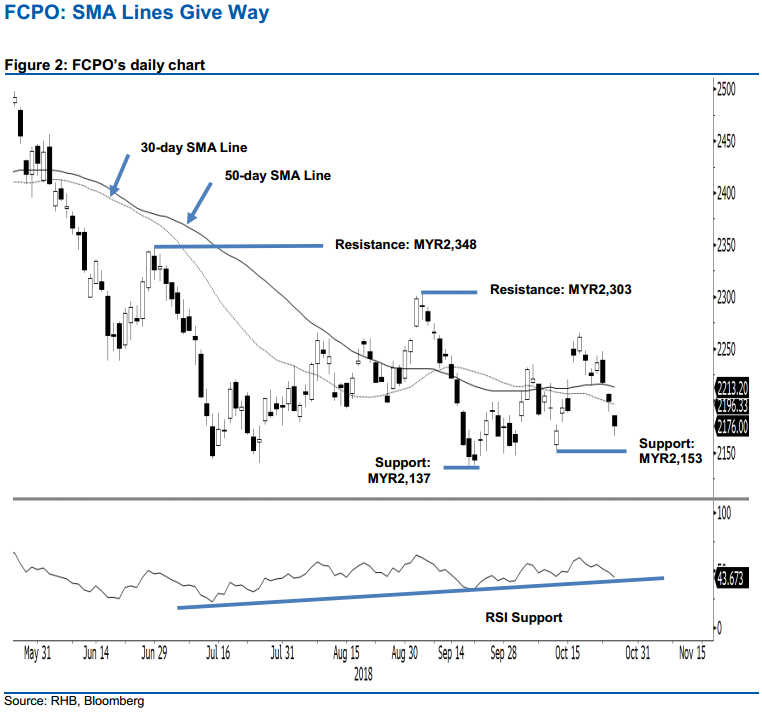

Maintain long positions until the immediate support is breached. The FCPO ended the latest trading on a negative note. At the closing, it breached both the 30-day and 50-day SMA lines. The session’s low and high were recorded at MYR2,166 and MYR2,186 before settling at MYR2,176 – implying a MYR24 drop. The breached SMA lines have increased the risk for the commodity to resume its YTD weakening trend. For now, a breach of the immediate support of MYR2,153 is needed to confirm such a prospect. Until this happens, the rebound that started from the low of MYR2,137 on 20 Sep is still valid. Hence, we maintain our positive trading bias.

Pending confirmation of the YTD weakening trend returning, we continue to recommend traders keep to long positions. To recap, we initiate these positions at MYR2,244, or the closing level of 16 Oct. For risk management purposes, a stop-loss can be placed below MYR2,153.

The immediate support is expected at MYR2,153, the low of 11 Oct. The second support is at MYR2,137, the low of 20 Sep. Moving up, the immediate resistance is set at MYR2,303, the high of 5 Sep. This is followed by MYR2,348, the high of 29 Jun.

Source: RHB Securities Research - 26 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024