FKLI - Strong Intraday Reversal

rhboskres

Publish date: Fri, 26 Oct 2018, 04:32 PM

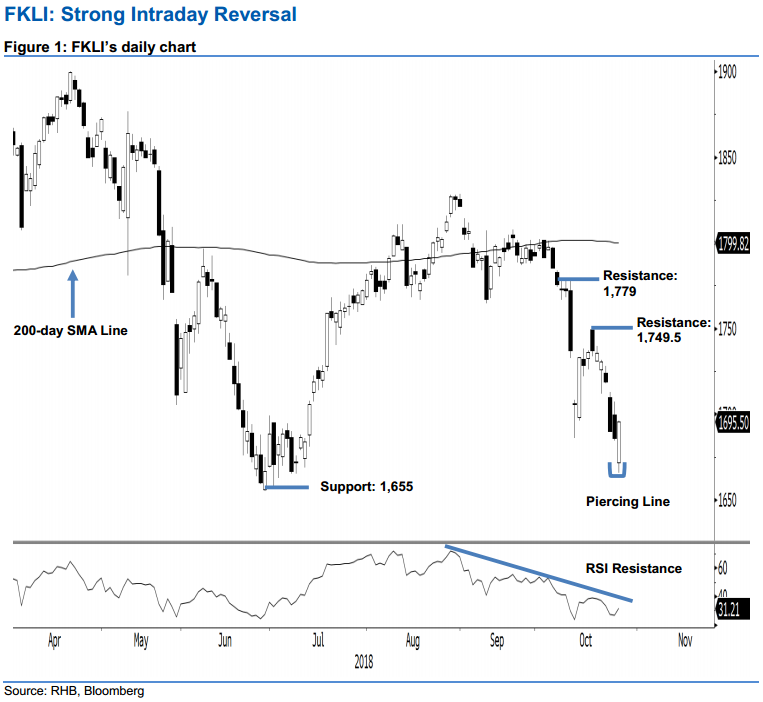

Maintain short positions while tightening the stop-loss. The FKLI performed positively in the latest trading, as the bulls managed to reverse the early session’s weak tone, a “Piercing Line” pattern was formed. The index generally scaled higher throughout the session from a low of 1,665.5 pts, posted in the early trading, before settling at the day’s high of 1,696 pts, indicating a gain of 10 pts. The intraday reversal is deemed as significant, more so, as it came on the oversold daily RSI reading. However, this is still not sufficient to indicate a deeper rebound or total trend reversal developing – we still need a positive follow-through in the coming sessions to confirm such possibility. Hence, we maintain our negative trading bias.

As further price evidence is needed to confirm the end of the recent steep retracement, we continue to recommend that traders keep to short positions – which we initiated at 1,737 pts, or 10 Oct’s closing level. For risk management purposes, a stop loss can be placed above 1,749.5 pts

We revised the immediate support to the 1,655-pt level, or the low of 28 June. This is followed by 1,600 pts, a round figure. Towards the upside, the immediate resistance is now placed 1,749.5 pts, or the high of 17 Oct. This is followed by 1,779 pts – the latest session’s high.

Source: RHB Securities Research - 26 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024