WTI Crude Futures - Consolidating Below 200-Day SMA

rhboskres

Publish date: Mon, 29 Oct 2018, 09:14 AM

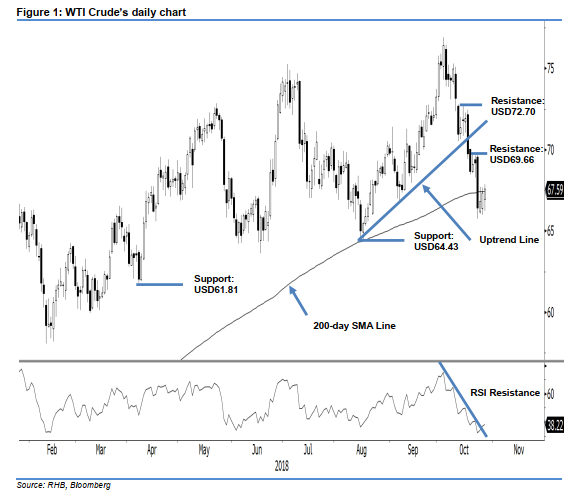

Maintain short positions as there are no signs of price reversal. The WTI Crude formed a white candle in the latest trading session to settle at USD67.59, indicating a gain of USD0.26. Intraday, the commodity was trading sideways between USD66.20-67.80. The latest three sessions’ price performances continue to show that the commodity is merely consolidating around the 200-day SMA line, and not showing signs of rebounding from the SMA line. As of now, this implies that the commodity’s negative bias is still firmly in place, and that once this consolidation phase ends, chances are high that the weak price trend could extend. Based on these, we maintain our negative trading bias.

As there are no price signals to suggest that the weak trend has finished, we continue to recommend traders to keep to short positions. We initiated short positions at USD70.97, which was the closing of 11 Oct. For risk management purposes, a stop-loss can be placed above the USD69.66 mark.

Immediate support is pegged at USD64.43, or the low of 16 Aug. This is followed by USD61.81, which was the low of 6 Apr. On the other hand, the immediate resistance is pegged at USD69.66, ie the high of the latest session. This is followed by USD72.70, which was 15 Oct’s high.

Source: RHB Securities Research - 29 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024