Hang Seng Index Futures - Bearish Outlook Remains Intact

rhboskres

Publish date: Mon, 29 Oct 2018, 09:14 AM

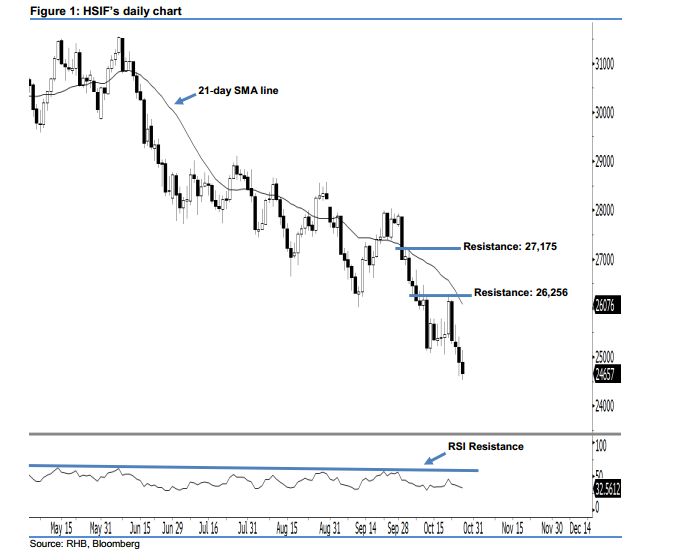

Stay short, with a trailing-stop set above the 26,256-pt resistance. The HSIF’s downside move continued as expected, after it ended lower to form a fourth consecutive black candle. It closed at 24,657 pts after oscillating between a high of 25,146 pts and low of 24,526 pts. As the index marked a lower close vis-à-vis the previous sessions since 23 Oct, this can be viewed as the bears extending their downward momentum. Moreover, as the 14-day RSI indicator is now declining lower without being oversold, the bearish sentiment has been enhanced.

As shown in the chart, the immediate resistance is maintained at 26,256 pts – this was determined from the high of 11 Oct’s long black candle. The next resistance is seen at 27,175 pts, ie the high of 4 Oct. Towards the downside, the near-term support is anticipated at the 24,000-pt psychological mark. This is followed by 23,706 pts, which was the previous low of 19 Apr 2017.

Consequently, we advise traders to maintain short positions, in line with our initial recommendation to have short positions below the 27,400-pt level on 3 Oct. A trailing-stop can be set above the 26,256-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 29 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024