FCPO - Negative Price Trend Likely To Resume

rhboskres

Publish date: Mon, 29 Oct 2018, 09:20 AM

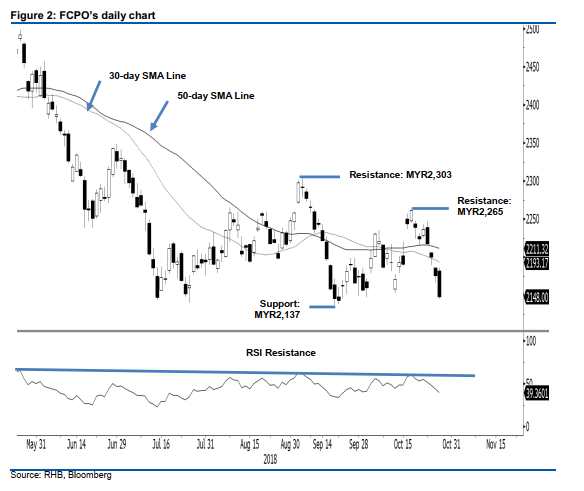

Initiate short positions as the bears are in the control. The FCPO performed weakly on Friday, as it generally moved lower during the entire session. The high and low were recorded at MYR2,186 and MYR2,145, before settling at MYR2,148, a decline of MYR28. The negative session has invalidated the previous immediate support of MYR2,153, thus suggesting the commodity’s YTD weakening is likely to resume. With the commodity now trading firmly below the 30-day and 50-day SMA lines, the negative bias is further validated. Hence, we switch our trading bias to negative.

Our previous long positions initiated at MYR2,244 – the closing level of 16 Oct was closed out during the latest session at MYR2,153. As the bears are now in control, we initiate short positions at the latest closing. For risk management purposes, a stop-loss can be placed at MYR2,265

The immediate support is revised to MYR2,137, the low of 20 Sep. This is followed by MYR2,100 mark, a round figure. Towards the upside, the immediate resistance is now set at MYR2,265.the high of 17 Oct. This is followed by MYR2,303, the high of 5 Sep.

Source: RHB Securities Research - 29 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024