FCPO - No Price Reversal Signal Yet

rhboskres

Publish date: Wed, 24 Oct 2018, 04:43 PM

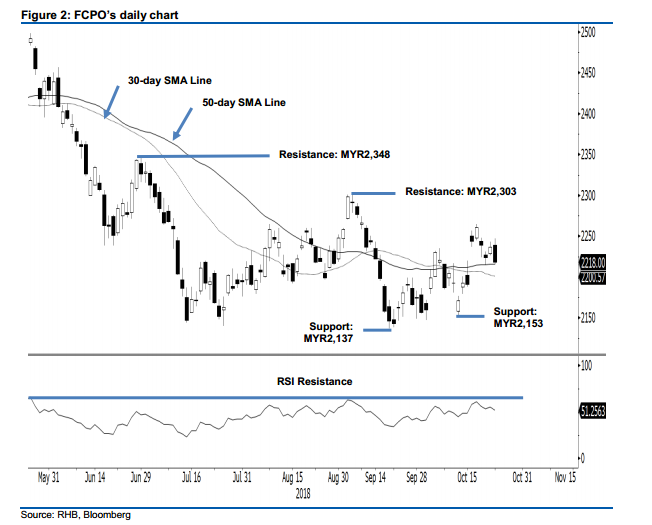

Maintain long positions as there is no clear sign of reversal yet. The FCPO ended the latest trading negatively – at the closing it came close to test the 50-day SMA line. The intraday tone was bearish as the commodity generally slid lower, with the high and low recorded at MYR2,247 and MYR2,215, before settling MYR19 lower at MYR2,218. However, the overall positive bias is still intact, with the risk of the commodity resuming its YTD negative trend still low – as the 30-day SMA and 50-day SMA lines are still holding. The daily RSI reading of 52.86 also indicates that the rebound has not been stretched. Hence, we maintain our positive trading bias.

As there are no signs indicating that the rebound has reached an end, we continue to recommend traders keep to long positions. To recap, we initiate these positions at MYR2,244, or the closing level of 16 Oct. For risk management purposes, a stop-loss can be placed below MYR2,153.

The immediate support is set at MYR2,153, the low of 11 Oct. The second support is at MYR2,137, the low of 20 Sep. Towards the upside, the immediate resistance is set at MYR2,303, the high of 5 Sep. This is followed by MYR2,348, the high of 29 Jun.

Source: RHB Securities Research - 24 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024