E-mini Dow Futures - Resistance at 25,338 Pts

rhboskres

Publish date: Tue, 30 Oct 2018, 04:20 PM

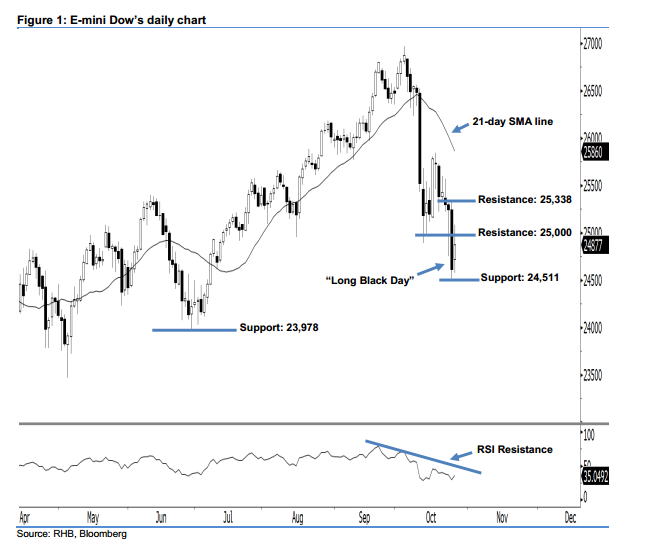

Stay short, with new trailing-stop above the 25,338-pt level. The E-mini Dow ended higher to form a white candle yesterday. It rose 261 pts to close at 24,877 pts, after oscillating between a high of 25,079 pts and low of 24,571 pts. Unsurprisingly, yesterday’s white candle should be viewed as a technical rebound following the recent plunges. We believe that the bears may continue to control the market as long as the E-mini Dow does not recoup losses that were created by 24 Oct’s “Long Black Day” candle. Overall, we keep our bearish view on the E-mini Dow’s outlook.

As seen in the chart, we anticipate the immediate resistance at the 25,000-pt psychological mark. The next resistance is now seen at 25,338 pts, determined from the high of 24 Oct’s “Long Black Day” candle. Towards the downside, the immediate support is situated at 24,511 pts, ie the previous low of 24 Oct. Meanwhile, the next support is seen at 23,978 pts, which was the previous low of 28 Jun.

Hence, we advise traders to maintain short positions, following our recommendation to initiate short below the 25,000-pt level on 25 Oct. For now, a new trailing-stop can be set above the 25,338-pt threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 26 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024