Hang Seng Index Futures - A Weak Recovery

rhboskres

Publish date: Tue, 30 Oct 2018, 09:10 AM

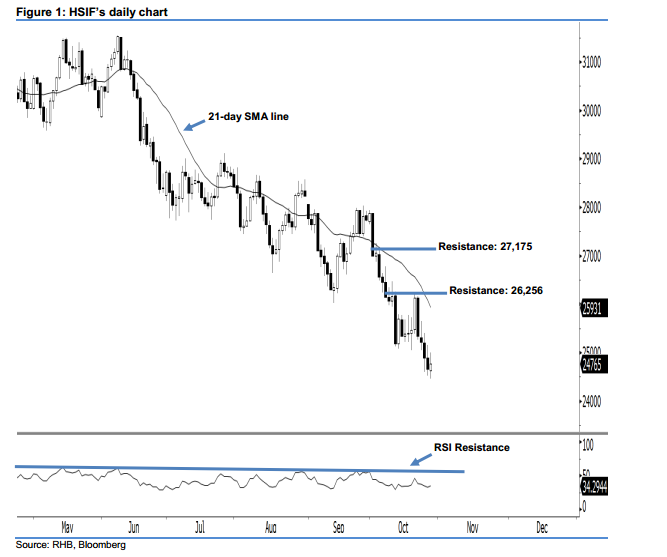

Maintain short positions. Following the black candles on 23-26 Oct, the HSIF ended higher to form a white candle yesterday. It settled at 24,765 pts, off its high of 24,997 pts and low of 24,457 pts. Unsurprisingly, yesterday’s white candle should merely be viewed as the result of bargain-hunting activities following recent losses. From a technical perspective, as the 21-day SMA line is still edging downwards, the market correction from early-February remains intact. Overall, we maintain our bearish view on the index’s outlook.

Based on the daily chart, we anticipate the immediate resistance at 26,256 pts, which was the high of 11 Oct’s long black candle. The next resistance will likely be at 27,175 pts, determined from the high of 4 Oct. To the downside, we are eyeing the near-term support at the 24,000-pt psychological spot. This is followed by 23,706 pts, obtained from the previous low of 19 Apr 2017.

Therefore, we advise traders to stay short, following our recommendation to initiate short below the 27,400-pt level on 3 Oct. A trailing-stop can be set above the 26,256-pt threshold in order to lock in part of the profits.

Source: RHB Securities Research - 30 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024