E-mini Dow Futures - Another Black Candle

rhboskres

Publish date: Tue, 30 Oct 2018, 09:12 AM

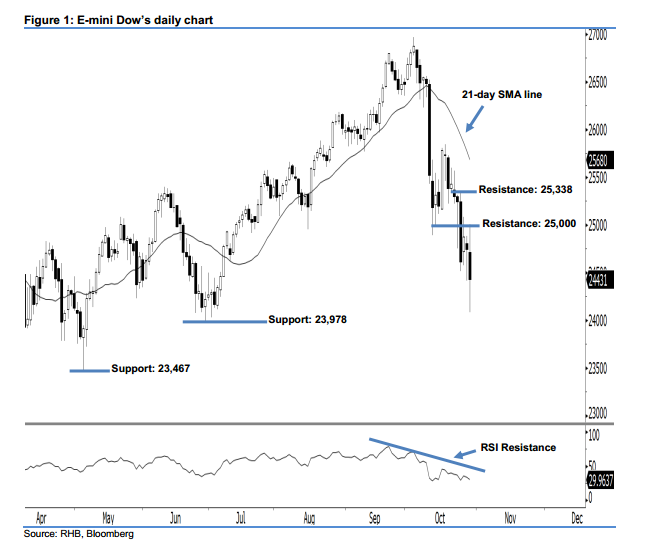

Stay short while setting a trailing-stop above the 25,338-pt resistance. Selling momentum in the E-mini Dow continued as expected. Another black candle was formed last night, which pointed towards a continuation of the downside move. It lost 315 pts to close at 24,431 pts, after oscillating between a high of 25,007 pts and low of 24,086 pts. The downside move is likely to continue, as the index posted a second consecutive black candle and hit its lowest point in nearly four months. This can be viewed as a continuation of sellers expanding the downside swing that started since early October.

Judging from the current outlook, the immediate resistance is seen at the 25,000-pt psychological mark. The next resistance is anticipated at 25,338 pts, ie the high of 24 Oct’s long black candle. On the other hand, the immediate support is now situated at 23,978 pts, which was the previous low of 28 Jun. If a breakdown arises, look to 23,467 pts – ie the low of 3 May – as the next support.

Hence, we advise traders to maintain short positions, since we had originally recommended initiating short below the 25,000-pt level on 25 Oct. A trailing-stop can be set above the 25,338-pt threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 30 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024