FCPO - Negative Bias Still In Place

rhboskres

Publish date: Tue, 30 Oct 2018, 09:17 AM

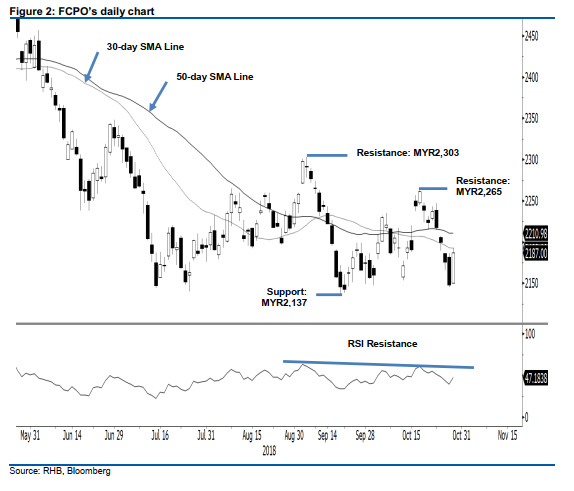

Maintain short positions as the trend is still weak. The FCPO formed a white candle in the latest trading – indicating the session was led by the bulls. Intraday, the tone was positive as the commodity generally trended higher from a low of MYR2,150 and MYR2,193, before ending at MYR2,187 – a gain of MYR39. The positive session can be seen as the bears taking a breather below the 30-day and 50-day SMA lines, after the recent declines. As long as the commodity is capped by both of the SMA lines, the overall negative bias would still be intact, and chances are still high for the YTD weak price trend to continue to extend. Hence, we maintain our negative trading bias.

With the possibility of the YTD weak price trend resuming is still high, we continue to recommend for traders to keep to short positions. We initiated these positions at MYR2,148, the closing level of 26 Oct. For risk management purposes, a stop-loss can be placed at MYR2,265

The immediate support is revised to MYR2,137, the low of 20 Sep. This is followed by MYR2,100 mark, a round figure Towards the upside, the immediate resistance is now set at MYR2,265, the high of 17 Oct. This is followed by MYR2,303, the high of 5 Sep.

Source: RHB Securities Research - 30 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024