FCPO - Bears Are In Control

rhboskres

Publish date: Wed, 31 Oct 2018, 04:22 PM

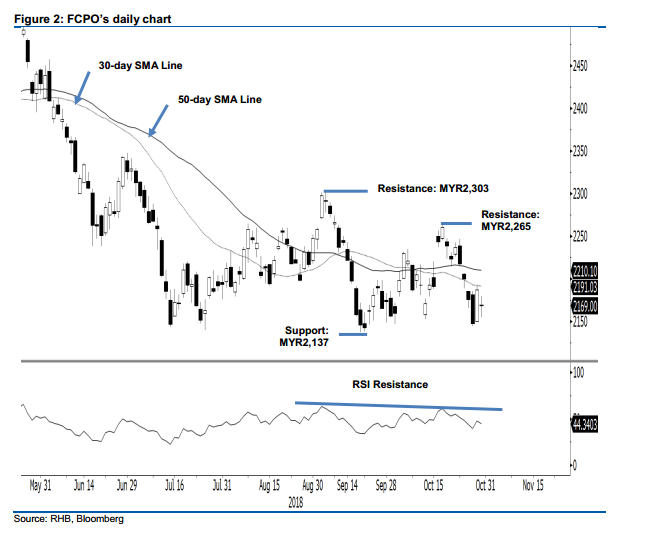

Maintain short positions. The FCPO ceased the latest trading session on a negative note. It settled MYR18 lower at MYR2,169. The low and high were at MYR2,155 and MYR2,180. The weak session continues to suggest that the commodity’s overall negative bias is still in place, and that the risk for its YTD negative price trend resuming is still very high. The fact that the commodity is now trading below both the 30-day and 50-day SMA lines, both of which are also starting to edge lower, lends support to the negative bias. Additionally, the weak daily RSI reading indicates that the underlying trend is weak. Towards the downside, a firm breach of the MYR2,137 immediate support would confirm the resumption of the YTD weak price trend. Hence, we maintain our negative trading bias.

As the negative bias continues to extend without showing signs of revering, we continue to recommend traders to keep to short positions. We initiated these positions at MYR2,148, the closing level of 26 Oct. For risk management purposes, a stop-loss can be placed at MYR2,265

The immediate support is set at MYR2,137, the low of 20 Sep. This is followed by the MYR2,100 mark, a round figure. Moving up, the immediate resistance is now set at MYR2,265, the high of 17 Oct. This is followed by MYR2,303, the high of 5 Sep.

Source: RHB Securities Research - 31 Oct 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024