WTI Crude Futures - Bears Are Pressing Down Further

rhboskres

Publish date: Thu, 01 Nov 2018, 08:40 AM

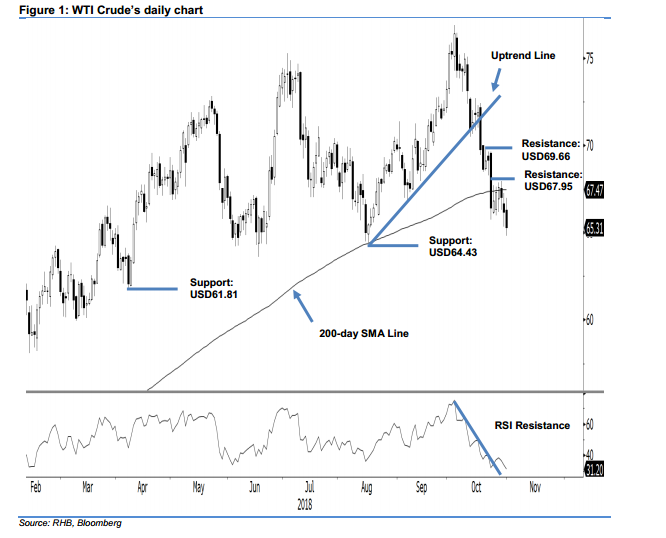

Maintain short positions while tightening up trailing-stop further. The WTI Crude closed the latest session on a negative note. Intraday tone was weak as the commodity generally trended lower. The high and low were posted at USD67 and USD64.81, before it settled at USD65.31 – this implies a USD0.87 decline. The weak session has further pushed the commodity below the 200-day SMA line – indicating that the bearish price trend is still developing without any exhaustion signals. This is despite the daily RSI now coming near to the oversold threshold. Until signs of a deeper price rebound emerge, we are keeping our negative trading bias.

As the bearish bias continues to play out, we continue to recommend traders to keep to short positions. We initiated short positions at USD70.97, which was the closing of 11 Oct. For risk management purposes, a stoploss can now be placed above the latest session’s high of USD67.

Towards the downside, the immediate support is set at USD64.43, or the low of 16 Aug. The following support is at USD61.81, which was the low of 6 Apr. Conversely, the immediate resistance is now expected at USD67.95, which was the high of 29 Oct. This is followed by USD69.66, the 23 Oct’s high.

Source: RHB Securities Research - 1 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024