FCPO - Bears Remain In Control

rhboskres

Publish date: Fri, 02 Nov 2018, 08:37 AM

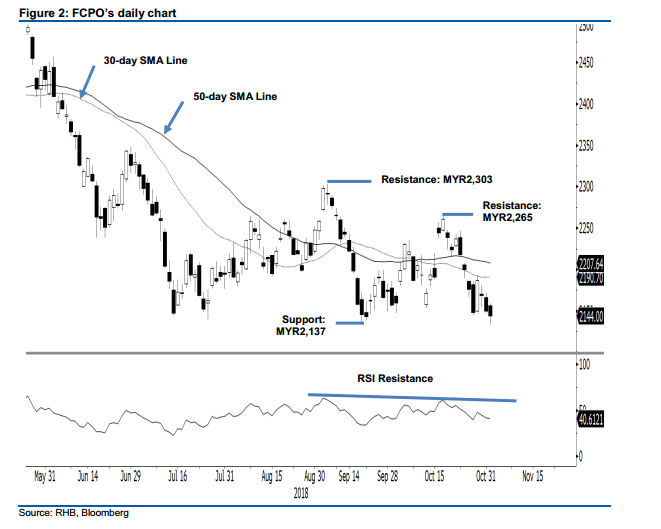

Maintain short positions as the YTD low is under pressure. The FCPO charted a weak session yesterday and, at one point, the bears tested the immediate support of MYR2,137. The session’s low and high were MYR2,133 and MYR2,159, before it ended MYR6 lower at MYR2,144. The attempt by the bears to breach the said immediate support –also the YTD low – indicates that the overall bearish tone is still in place. Should the said support be broken decisively, it would signal the extension of the commodity’s YTD negative price trend. The weak daily RSI reading of 40.60 indicates that the momentum is weak, and the retracement so far has yet to reach an oversold threshold. Hence, we maintain our negative trading bias.

Without any signs that the weak price trend is reaching an end, we continue to recommend that traders to keep to short positions. We initiated these positions at MYR2,148, the closing level of 26 Oct. For risk management purposes, a stop-loss can be placed at MYR2,265.

Immediate support is expected at MYR2,137, the low of 20 Sep. The second support is at the MYR2,100 mark, a round figure. Moving up, the immediate resistance is now set at MYR2,265, the high of 17 Oct. This is followed by MYR2,303, the high of 5 Sep.

Source: RHB Securities Research - 2 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024