COMEX Gold - Away From Risk of Deeper Retracement

rhboskres

Publish date: Fri, 02 Nov 2018, 04:46 PM

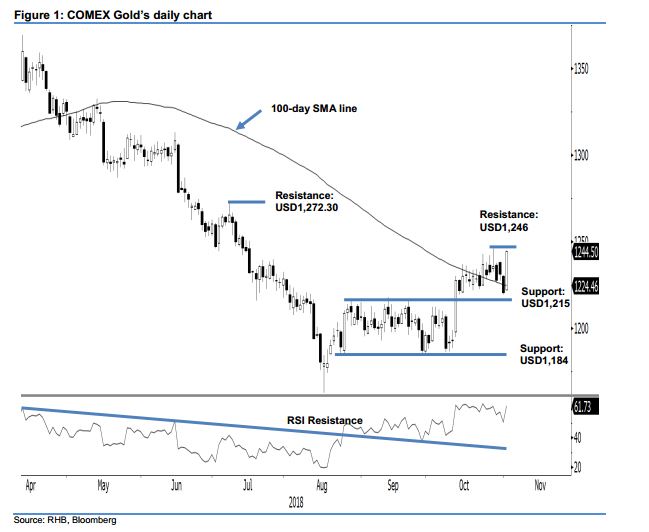

Maintain long positions as the commodity bounced back from the risk of deeper retracement. The COMEX Gold formed a long white candle in the latest trading session, effectively pushing itself back above the 100-day SMA line, and came near to testing the revised immediate resistance of USD1,246. The intraday tone was positive as the commodity generally trended up for the whole session – with the low and high posted at USD1,222.30 and USD1,245, before ending USD23.70 higher at USD1,245. The strong price reaction came after the prior sessions’ retracement saw the commodity coming close to signalling a possible deeper retracement. This also suggests that previous prospects for the commodity to be rejected from the 100-day SMA line are no longer valid for now. As such, we are keeping our positive trading bias.

Given that the commodity may still be able to rebound further, we continue to advise traders to keep their long positions. Recall that we initiated these positions after the COMEX Gold breached above the USD1,207.60 mark on 12 Sep. For risk management purposes, a stop-loss can now be placed below USD1,222.30, The latest session’s low.

We are eyeing the immediate support at the USD1,215 mark, or 20 Jul’s low. The following support is at USD1,184, which was the low of 24 Aug. Conversely, the immediate resistance is now pegged at USD1,246 mark, ie 26 Oct’s high. This is followed by the USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 2 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024