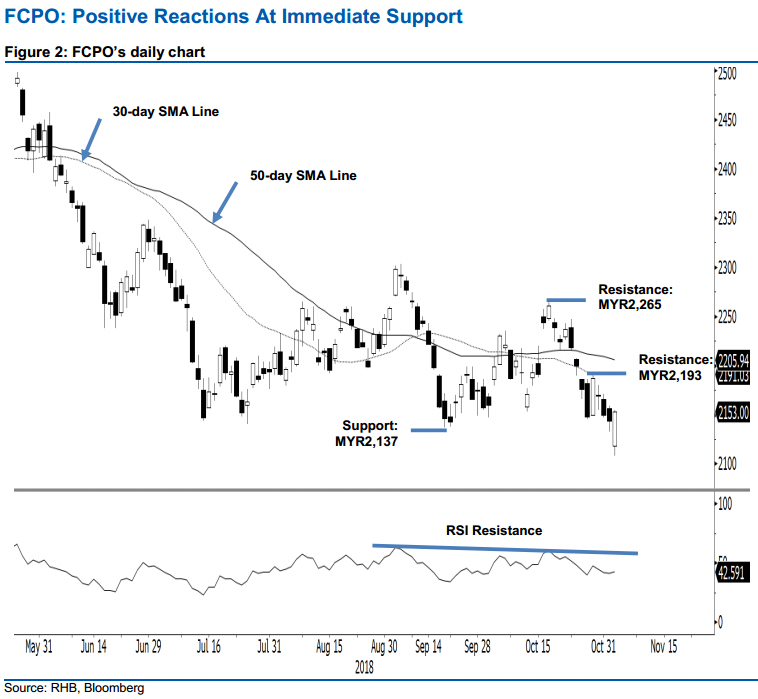

FCPO - Positive Reactions At Immediate Support

rhboskres

Publish date: Mon, 05 Nov 2018, 09:06 AM

Maintain short positions while revising down trailing-stop. The FCPO formed a white candle last Friday, after it tested the immediate support of MYR2,137 – which indicates that the bulls were emerging around the said support mark. After a weak opening, the commodity trended up for the entire session to a high of MYR2,155, from a low of MYR2,108, before closing MYR9 higher at MYR2,153. The relative strong intraday rebound means there is still no confirmation that the commodity’s YTD negative price trend is resuming. Towards the upside, for now, if commodity breaks above the revised immediate resistance of MYR2,193 – which is also near the 30-day SMA line – chances are high that a deeper rebound could take place. Until this happens, we maintain our negative trading bias.

Until the signal of a deeper rebound is confirmed, we still recommend that traders keep to short positions. We initiated these positions at MYR2,148, the closing level of 26 Oct. For risk management purposes, a stop-loss can now be placed at MYR2,193.

Immediate support is pegged at MYR2,137, the low of 20 Sep. The second support is at the MYR2,100 mark. Moving up, we revised the immediate resistance to MYR2,193, the high of 29 Oct. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 5 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024