COMEX Gold - Pausing Below Immediate Resistance

rhboskres

Publish date: Mon, 05 Nov 2018, 09:15 AM

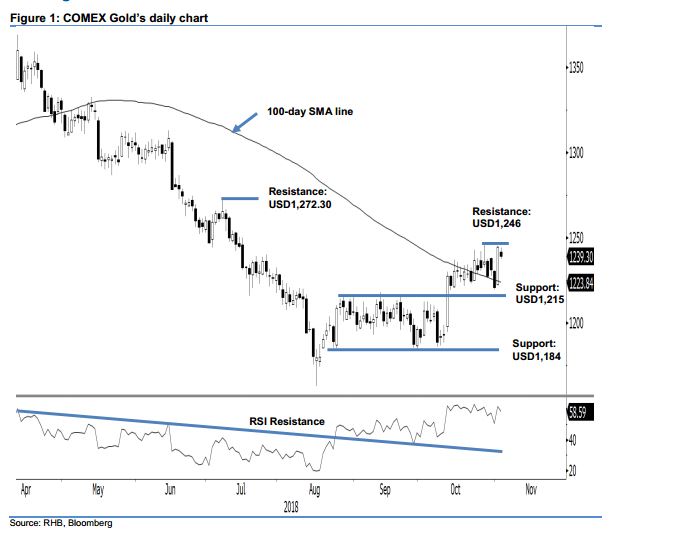

Maintain long positions as the commodity is pausing below the resistance mark. The COMEX Gold formed a black candle in the latest trading – as it eased USD5.20 to settle at USD1,239.30. Intraday, it ranged between USD1,237.30 and USD1,244. The weak session can be seen as a sign bulls are taking a breather after the previous session’s strong performance. For now, the bias is for the commodity to consolidate around the immediate resistance of USD1,246, before resuming its upward move – with no signs of a price rejection signal from the said immediate resistance spotted yet. The daily RSI reading of 58.59 is suggesting the commodity’s rebound is not stretched yet. As such, we are keeping our positive trading bias.

As the latest weak session does not indicate that the bulls have run out of steam, we continue to advise traders to keep their long positions. Recall that we initiated these positions after the COMEX Gold breached above the USD1,207.60 mark on 12 Sep. For risk management purposes, a stop-loss can now be placed below USD1,222.30.

Towards the downside, immediate support is at the USD1,215 mark, or 20 Jul’s low. The second support is at USD1,184, which was the low of 24 Aug. Moving up, the immediate resistance is set at USD1,246 mark, ie 26 Oct’s high. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 5 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024