FKLI - Still Eying Bigger Rebound

rhboskres

Publish date: Wed, 07 Nov 2018, 04:21 PM

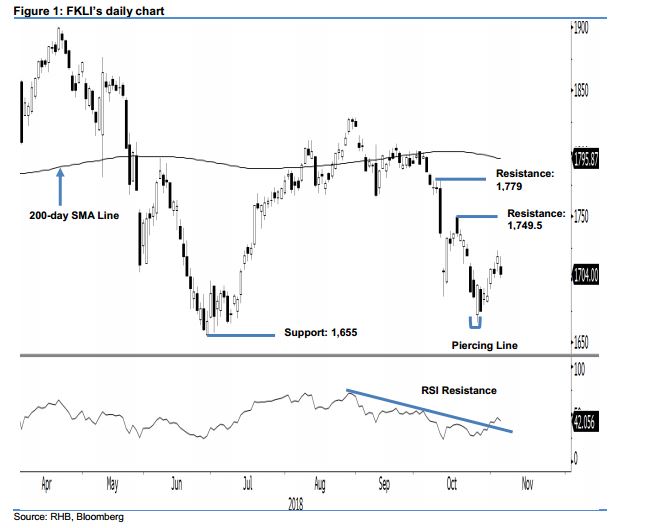

Maintain long positions. The FKLI settled the latest session on a negative note. For the intraday, the index registered a low and high of 1,701 pts and 1,718 pts, before it ended 14 pts lower at 1,704 pts. The weak session can be seen as a sign that the bulls are taking a breather after the recent rebound. Overall, the positive bias that started from the low of the “Piercing Line” formation is still in place and likely to extend further. This rebound phase is triggered after the index experienced a sharp retracement after it was rejected from the 200-day SMA line of 10 Oct, which saw its daily RSI reach an oversold threshold recently. Based on these, we maintain our positive trading bias.

As the bulls are still in control over the rebound, we continue to recommend traders staying in long positions – which we initiated at 1,718 pts or 2 Nov’s closing level. For risk management purposes, a stop-loss can be placed at 1,655 pts.

The immediate support stays at the 1,655-pt level, the low of 28 June. The second support is at the 1,600-pt mark. Moving up, the immediate resistance is now expected at 1,749.5 pts, or the high of 17 Oct. This is followed by 1,779 pts, the high of 10 Oct.

Source: RHB Securities Research - 7 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024