FCPO - Tightening Up Trailing-Stop

rhboskres

Publish date: Thu, 08 Nov 2018, 04:52 PM

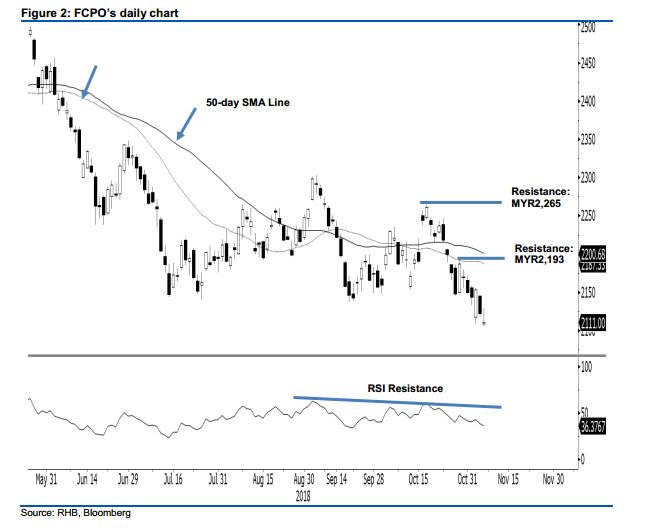

Negative price trend continues to develop; maintain short positions. The FCPO formed a black candle yesterday, shedding MYR11 to settle at MYR2,111. The low and high were at MYR2,105 and MYR2,129. The weak session continues to suggest that the commodity’s YTD negative price trend is extending. Lending further support to this negative bias is the fact that the commodity is now trading well below both the 30-day and 50-day SMA lines, both also starting to show signs of edging lower. Meanwhile, the weak daily RSI reading also indicates a weak momentum. As such, we maintain our negative trading bias.

As the price trend is still tilted towards the downside, we continue to recommend that traders keep to short positions. We initiated these at MYR2,148, the closing level of 26 Oct. To manage risks, a stop-loss can be set at the breakeven mark.

The immediate support is pegged at MYR2,100 mark, a round figure. The second support is expected at MYR2,000, also a round figure. Conversely, the immediate resistance set at MYR2,193, the high of 29 Oct. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 8 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024