Hang Seng Index Futures - Long Positions Still in Play

rhboskres

Publish date: Fri, 09 Nov 2018, 04:31 PM

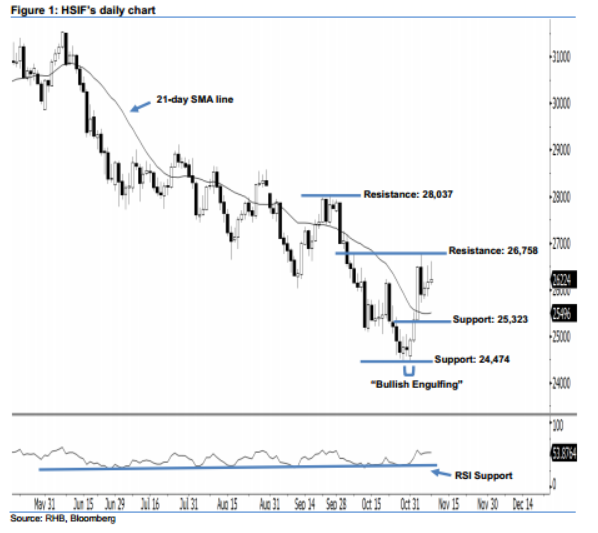

Stay long, with a stop-loss set below the 24,474-pt support. The HSIF formed another positive candle yesterday. It settled at 26,224 pts, off its high of 26,614 pts and low of 26,104 pts. Technically, we think the bullish sentiment stays unchanged, as the index is still trading above the recent 24,474-pt support mentioned previously. As long as the HSIF fails to negate the bullishness of the “Bullish Engulfing” pattern that formed on 30-31 Oct, we believe buyers still have control over the market. Overall, we think the rebound that started from the aforementioned pattern may persist.

As seen in the chart, we are eyeing the immediate support at 25,323 pts, ie the low of 2 Nov’s long white candle. The next support is seen at 24,474 pts, determined from the low of 31 Oct’s “Bullish Engulfing” pattern. Towards the upside, the immediate resistance is seen at 26,758 pts, which was the high of 5 Nov. If this level is taken out, look to 28,037 pts – obtained from the previous high of 26 Sep – as the next resistance.

Therefore, we advise traders to stay long, following our recommendation to initiate long above the 25,900-pt level on 5 Nov. In the meantime, a stop-loss can be set below the 24,474-pt threshold in order to minimise downside risk.

Source: RHB Securities Research - 9 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024