FKLI - Sentiment Remains Positive

rhboskres

Publish date: Fri, 09 Nov 2018, 04:33 PM

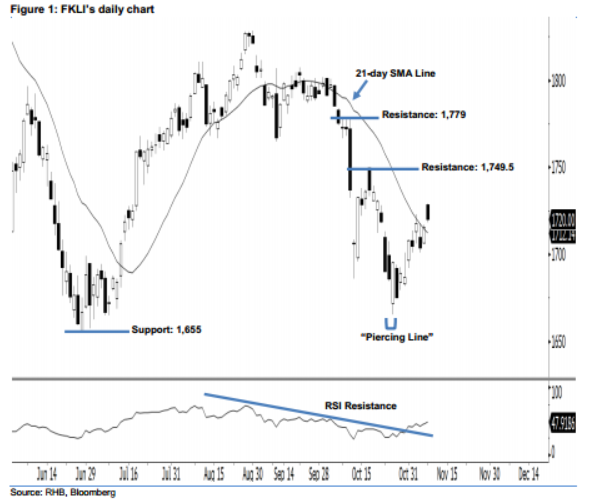

Upside move likely to continue; stay long. The FKLI’s uptrend continued as expected after it ended higher and left an upside gap yesterday. It gained 4.50 pts to close at 1,720 pts, after hovering between a high of 1,729 pts and low of 1,718.50 pts. Technically speaking, as the index has climbed above the 21-day SMA line and hit its highest point in more than two weeks, this can be viewed as the buyers extending their upward momentum. Furthermore, yesterday’s higher close can be viewed as a continuation of the bulls extending the rebound from 25 Oct’s “Piercing Line” pattern. Overall, we remain positive on the FKLI’s outlook.

According to the daily chart, the immediate support level is at 1,655 pts, determined from the previous low of 28 June. If this level is taken out, the next support is maintained at the 1,600-pt psychological spot. To the upside, we anticipate the immediate resistance level at 1,749.50 pts, ie the high of 17 Oct. Meanwhile, the next resistance is seen at 1,779 pts, the high of 10 Oct’s long black candle.

As such, we advise traders to stay long, following our recommendation of initiating long positions above the 1,718-pt level on 5 Nov. At the same time, a stop-loss can be set below the 1,655-pt threshold to minimise the downside risk.

Source: RHB Securities Research - 9 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024