FCPO - Persistent Selling Momentum

rhboskres

Publish date: Mon, 12 Nov 2018, 08:58 AM

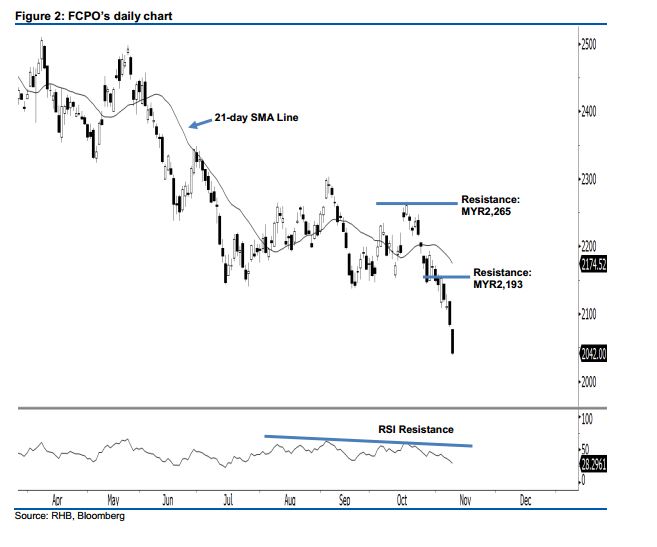

Stay short. Downward momentum in the FCPO continued as expected, as another black candle was formed last Friday. It lost MYR43 to close at MYR2,042, after oscillating between a high of MYR2,077 and low of MYR2,039. Technically speaking, the index has marked a lower close vis-à-vis the previous sessions since 8 Nov. This indicates that the downside swing, which started from 18 Oct’s black candle, may continue. In view that the 21- day SMA line is likely to begin turning downwards, this means that the bearish sentiment has been enhanced. Overall, we stay negative on the FCPO’s outlook.

According to the daily chart, we are eyeing the immediate support level at the MYR2,000 psychological spot. If a decisive breakdown arises, look to MYR1,863 – ie the previous low of 25 Aug 2015 – as the next support. Towards the upside, the immediate resistance level is seen at MYR2,193, which was the high of 29 Oct. The next resistance is anticipated at MYR2,265, obtained from the previous high of 17 Oct.

Thus, we advise traders to stay short, given that we previously recommended initiating short below the MYR2,148 level on 29 Oct. A stop-loss is advisable to set above the MYR2,148 threshold as well in order to minimise the risk per trade

Source: RHB Securities Research - 12 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024