COMEX Gold - Trailing-Stop Hits

rhboskres

Publish date: Mon, 12 Nov 2018, 09:00 AM

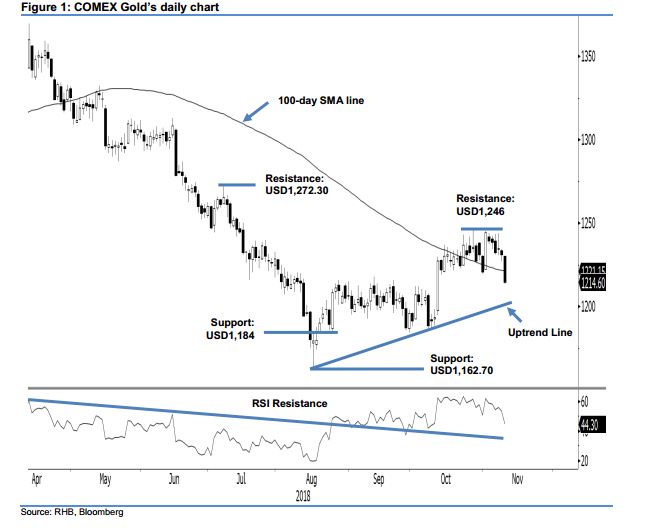

Initiate short positions as the bulls are losing energy. The COMEX Gold formed a black candle in the latest trading – at the closing it breached below both the previous immediate support of USD1,215 and the 100-day SMA line, albeit marginally. Session’s low and high were at USD1,213.30 and USD1,230.30, before it closed at USD1,214.60, indicting a decline of USD16.60. The breakdown from the said previous support and SMA levels may suggest there is a price rejection from the USD1,246 resistance mark – which the bulls attempted to breach in the recent weeks. Based on the current landscape, at the minimum, the uptrend line (as drawn in the chart) could be tested). On these, we switch our trading bias to negative.

Our previous long positions, initiated after the COMEX Gold breached above the USD1,207.60 mark on 12 Sep, were closed out in the latest trading session at USD1,222.30. On the bias that the commodity may re-test the said uptrend line, we initiate short positions at the latest closing. For risk management purposes, a stop-loss can be placed at 1,230.30 ie the latest session’s high.

We revise the immediate support to USD1,184, which was the low of 24 Aug. The following support may appear at USD1,162.70, the low of 16 Aug. Conversely, the immediate resistance is now eyed at USD1,246, the high of 26 Oct. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 12 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024