E-mini Dow Futures - Outlook Remains Positive

rhboskres

Publish date: Mon, 12 Nov 2018, 09:02 AM

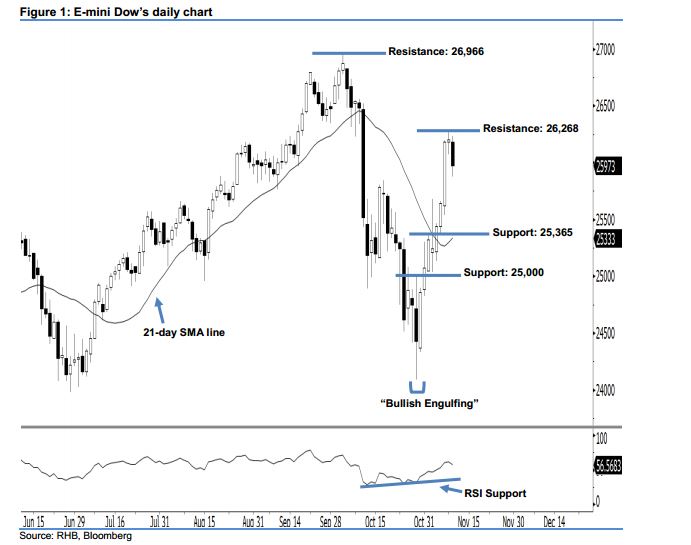

Stay long while setting a trailing-stop below the 25,365-pt support. After the market rose for four consecutive sessions, the E-mini Dow ended lower to form a black candle last Friday. It closed at 25,973 pts – off its high of 26,236 pts and low of 25,874 pts. However, based on the current outlook, we note the index is still holding above the 21-day SMA line, which signals that the positive sentiment remains unchanged. On a technical basis, the bulls may continue to control the market as long as the E-mini Dow fails to erase the gains from 6-7 Nov’s white candles. Overall, we think the market rebound, which began from 30 Oct’s “Bullish Engulfing” pattern, may continue.

As seen in the chart, we are eyeing the near-term support at 25,365 pts, which was the low of 6 Nov. This is followed by the 25,000-pt psychological spot. To the upside, the immediate resistance is now anticipated at 26,268 pts, ie the high of 8 Nov. Meanwhile, the next resistance will likely be at the 26,966-pt historical high.

Consequently, we advise traders to stay long, in line with our initial recommendation of having long positions above the 24,823-pt level on 1 Nov. A trailing-stop can be set below the 25,365-pt mark in order to lock in part of the profits.

Source: RHB Securities Research - 12 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024