WTI Crude Futures - Bears Are Relentless

rhboskres

Publish date: Tue, 13 Nov 2018, 09:06 AM

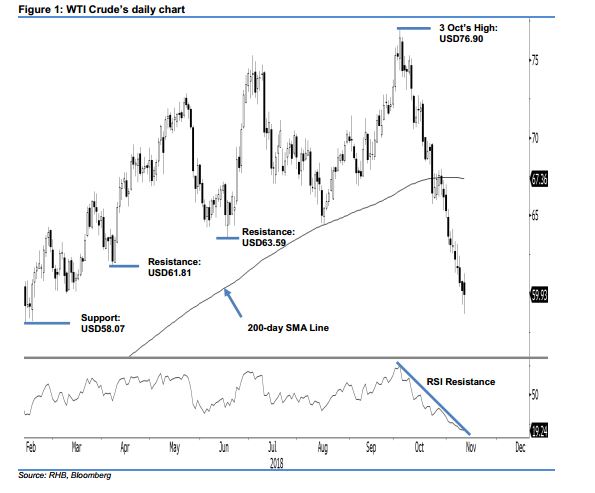

Maintain short positions as there are no price indications of bulls emerging. The WTI Crude ended the latest trading session on a negative note – at the closing, it marginally breached the previous immediate support of USD60. Intraday price posture was weak, as the commodity generally slid lower for the entire session. The high and low were recorded at USD61.28 and USD58.68, before closing at USD59.93, indicating a decline of USD0.26. The latest weak performance means the black gold’s sharp retracement from the high of USD76.90 on 3 Oct is still ongoing and not showing signs of coming to an end. While the daily RSI has reached an oversold reading of 19.24, there are no price actions that could indicate a possible rebound is developing. On these, we are keeping our negative trading bias.

With no indications that a rebound may be taking place, we continue to recommend traders keep to short positions. We initiated short positions at USD70.97, which was the closing of 11 Oct. For risk management purposes, a stop-loss can now be placed above the USD62.42 mark.

Immediate support is revised to USD58.07, the low of 9 Feb. This is followed by USD55, a round figure. Conversely, immediate resistance is set at USD61.81, the low of 6 April. The following resistance is at USD63.59, which was the low of 18 Jun.

Source: RHB Securities Research - 13 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024