FCPO - No Reversal Signal Yet

rhboskres

Publish date: Tue, 13 Nov 2018, 09:06 AM

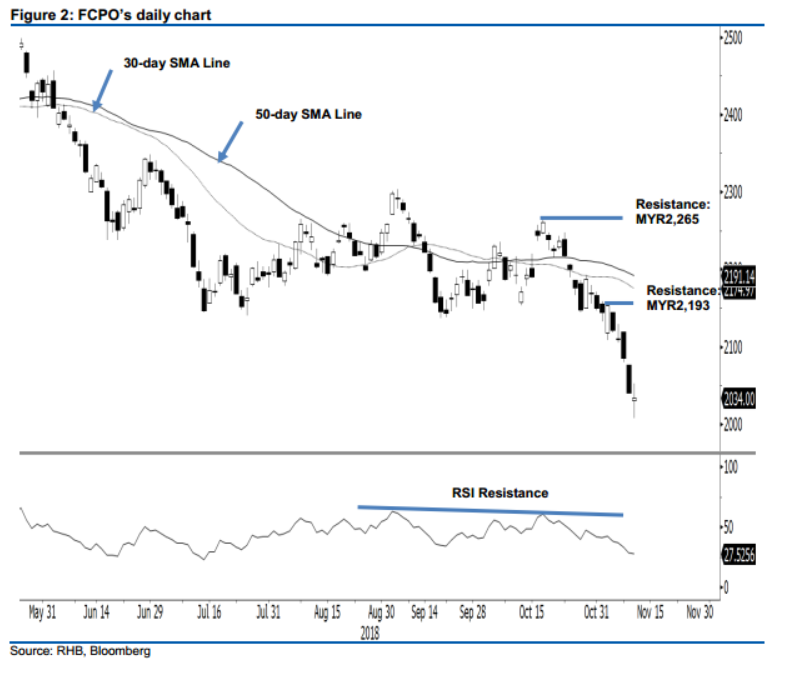

Bears are still leading; maintain short positions. The FCPO had a weak session yesterday. Intraday, the commodity registered a low and high of MYR2,008 and MYR2,053, before closing at MYR2,034, indicating a decline of 6 pts. The negative points towards the extension of the YTD weak price trend. This is further evidenced by the 30-day and 50-day SMA lines, which have started to show signs of edging lower. While the daily RSI has reached an oversold threshold, without price actions to suggest a deeper rebound is possibly, we keep to our negative trading bias.

As the negative price trend has yet to show signs of reaching an end, we continue to recommend traders to keep to short positions. We initiated these at MYR2,148, the closing level of 26 Oct. To manage risks, a stop-loss can be set at the breakeven mark.

We are eying MYR2,000, ie a psychological level as the immediate support. This is followed by MYR1,863, the low of 25 Aug 2015. Conversely, the immediate resistance is set at MYR2,193, the high of 29 Oct. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 13 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024