COMEX Gold - Nearing the Uptrend Line

rhboskres

Publish date: Wed, 14 Nov 2018, 04:28 PM

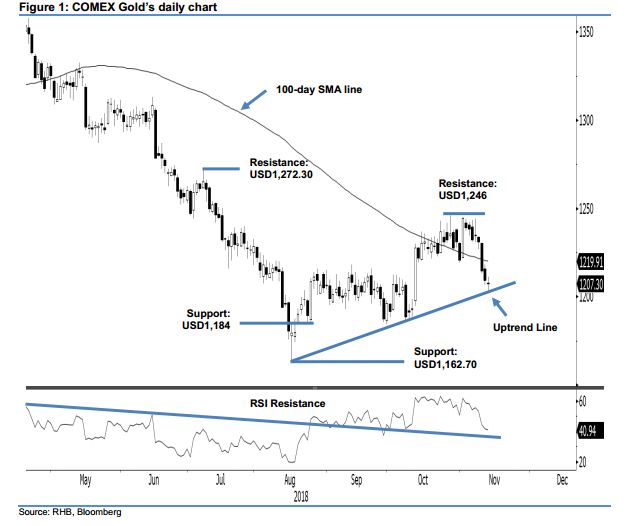

Maintain short positions while keeping the trailing-stop tighter. The COMEX Gold ended the latest session on a soft tone as it came near to testing the uptrend line (as drawn in the chart). It eased USD2.10 to settle at USD1,207.30. The low and the high were registered at USD1,202.40 and USD1,211.30. The weak session means the price retracement that started from the immediate resistance of USD1,246 is still in development. While the latest session has seen our minimum retracement target reached, in the absence of a price reversal signal from the said uptrend line, we are keeping our negative trading bias.

Until we see signs that the commodity is rebounding from the said uptrend line, we continue to recommend traders to keep to short positions, which were initiated at USD1,214.60, the closing level of 9 Nov. For risk management purposes, a stop-loss can be placed at the breakeven level.

We still eye the immediate support at USD1,184, which was the low of 24 Aug. The following support is at USD1,162.70, the low of 16 Aug. Towards the upside, the immediate resistance is set at USD1,246, the high of 26 Oct. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 14 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024