WTI Crude Futures - Decline Is Extending

rhboskres

Publish date: Wed, 14 Nov 2018, 04:29 PM

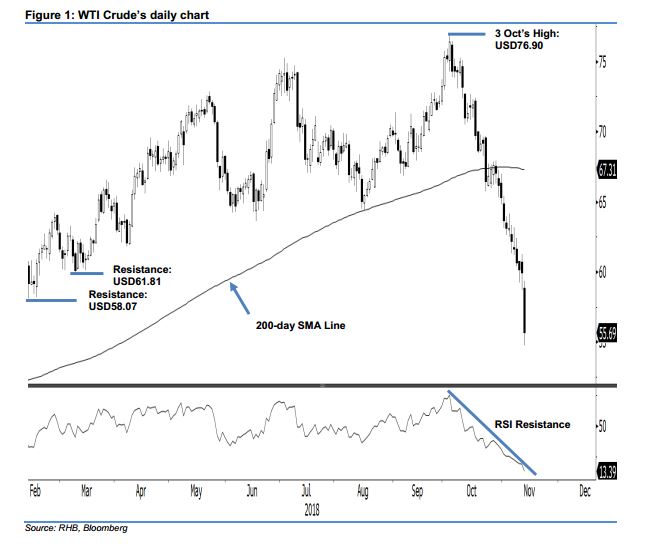

Maintain short positions as the bears are charging ahead. The WTI Crude formed a long black candle in the latest session and at the closing breached the previous immediate support of USD58.07. Intraday, the commodity moved lower throughout the session with the high and low posted at USD59.35 and USD54.75, before ending at USD55.69, indicating a decline of USD3.94. The latest session’s sharp decline continues to signal that the steep retracement that started from the high of USD76.90 on 3 Oct is still extending. This is despite the daily RSI having now reached an oversold reading of 13.39. In the absence of a price reversal signal, we are keeping our negative trading bias.

With the bears still clearly in control, we continue to recommend traders keep to short positions. We initiated short positions at USD70.97, which was the closing of 11 Oct. For risk management purposes, a stop-loss can now be placed above the USD59.35 mark, ie the latest session’s high.

Immediate support is revised to USD55, a round figure. This is followed by USD50, which is also a round figure. Moving up, immediate resistance is now set at USD58.07, the low of 9 Oct. This is followed by USD61.81, the low of 6 Apr.

Source: RHB Securities Research - 14 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024