FCPO - Sliding Even Lower

rhboskres

Publish date: Wed, 14 Nov 2018, 04:32 PM

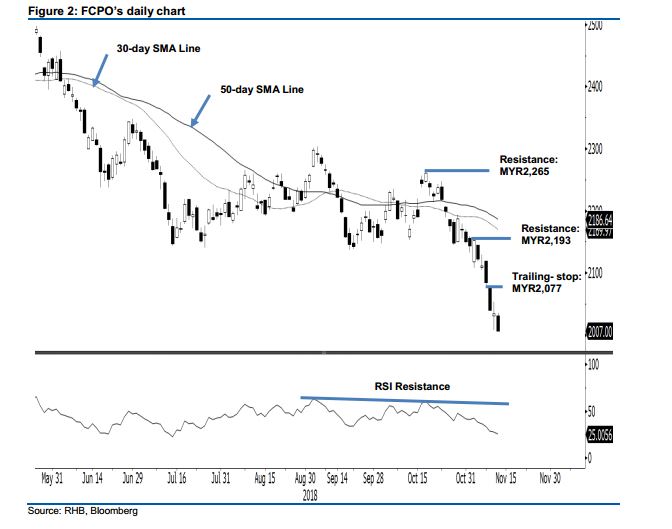

Maintain short positions as the MYR2,000 psychological mark is under pressure. The FCPO ceased the latest trading session on a negative note – it formed a black candle which came near to test the MYR2,000 psychological threshold. Intraday, the tone was weak as the commodity trended lower throughout the session from a high of MYR2,036 to a low of MYR 2,006, before settling at MYR2,007, indicating a decline of MYR27. The weak session is an extension of the commodity’s YTD declining price trend. This negative bias is supported by the fact that the commodity is now trading firmly below both the 30-day and 50-day SMA lines. While its daily RSI has reached an oversold threshold, without a price signal to suggest a rebound is possibly developing, we keep to our negative trading bias.

With the bears clearly in control over price direction, we continue to recommend traders to keep to short positions. We initiated these at MYR2,148, or the closing level of 26 Oct. To manage risks, a stop-loss can now be set at above the MYR2,077 mark.

We peg MYR2,000, ie a psychological level, as the immediate support. The second support is at MYR1,863, the low of 25 Aug 2015. On the other hand, the immediate resistance is set at MYR2,193, the high of 29 Oct. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 14 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024