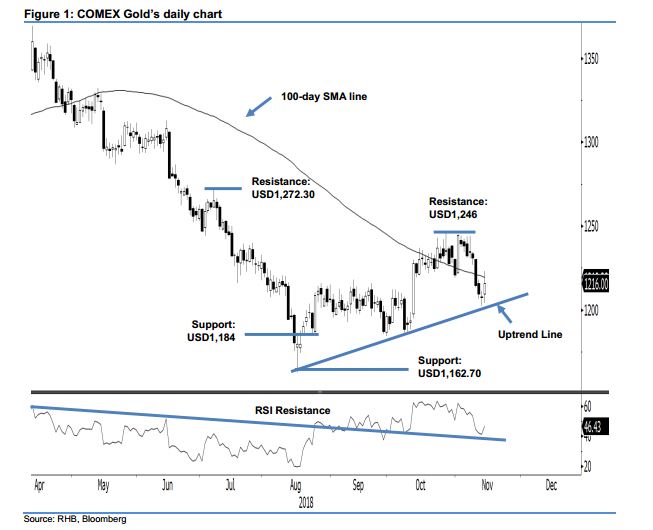

COMEX Gold - Bouncing Off From the Uptrend Line

rhboskres

Publish date: Thu, 15 Nov 2018, 08:40 AM

Initiate long positions as the bulls are pushing back from the uptrend line. The COMEX formed a white candle in the latest trading session and in the process came near to testing the 100-day SMA line. For the intraday, the commodity posted a low and high of USD1,204 and USD1,223.20, before closing at USD1,216, indicating a gain of USD8.70. The encouraging session can be seen as a positive follow-up after the uptrend line (as drawn in the chart) was almost tested in the prior session – indicating that bulls are probably re-emerging. This positive could be further enhanced, should the said SMA line be cracked in the coming sessions. Hence, we change our trading bias to positive.

Our previous short positions that we initiated at USD1,214.60, the closing level of 9 Nov, were closed out at the breakeven in the latest session. On the bias that the commodity is rebounding from the said uptrend line, we initiate long positions at the latest closing level. For risk management purposes, a stop-loss can be placed at USD1,184.

The immediate support is USD1,184, which was the low of 24 Aug. This is followed by USD1,162.70, the low of 16 Aug. Moving up, the immediate resistance is set at USD1,246, the high of 26 Oct. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 15 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024