COMEX Gold - Rebound Is Continuing

rhboskres

Publish date: Fri, 16 Nov 2018, 04:35 PM

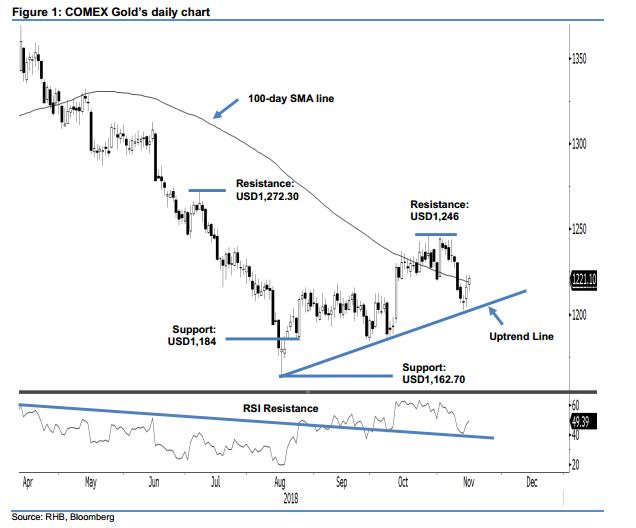

Continues to bounce off from the uptrend line, maintain long positions. The COMEX Gold formed a white candle in yesterday’s session and at the closing it marginally crossed the 100-day SMA line. For the intraday, the commodity was trading in the range of USD1,213.30 and USD1,222.80, before closing at USD1,221.10, implying a gain of USD4.90. The positive session is suggesting the commodity’s upward move since the low of USD1,162.70 is likely to extend, after it came near to test uptrend line (as drawn in the chart) on 13 Nov. The successful crossing of the said SMA line is also lending support to this positive bias, while the daily RSI indicator – which is starting to edge higher – is also suggesting momentum is picking up. Based on these, we keep to our positive trading bias.

As it appears likely for the commodity to extend its upward move, we continue to recommend that traders keep to long positions at USD1,216, which was the closing level of 14 Nov. For risk management purposes, a stop-loss can be placed at USD1,184.

Towards the downside, immediate support is pegged at USD1,184, which was the low of 24 Aug. The second support is at USD1,162.70, the low of 16 Aug. Conversely, the immediate resistance is set at USD1,246, the high of 26 Oct. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 16 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024