FCPO - Bears May Be Pausing

rhboskres

Publish date: Fri, 16 Nov 2018, 04:39 PM

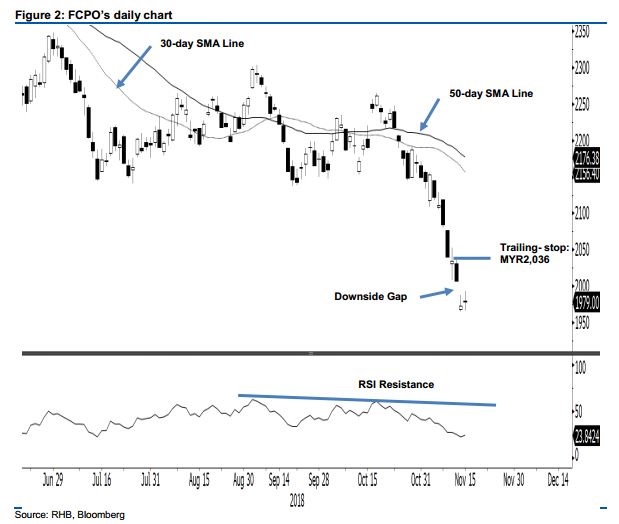

Maintain short positions as the bearish trend is still firmly intact. The FCPO closed slightly on the positive yesterday. The session’s low and high were at MYR1,966 and MYR1,993, before it closed at MYR1,979, implying a gain of MYR6. The latest session indicates that the bears were probably taking a breather after the past one month’s steep retracement, which sent the daily RSI reading into oversold territory. For now, the overall weak YTD price trend is still considered as valid, and not showing any signs of ending – since we have not spotted any clear sign that a deeper rebound is in the making. Both the 30-day and 50-day SMA lines, which continue to edge lower, also point to a bearish bias. Based on this, we keep to our negative trading bias.

As there are still no price reversal signals to suggest an end to the current downtrend in prices, we still recommend that traders keep to short positions. We initiated these at MYR2,148, or the closing level of 26 Oct. To manage risks, a stop-loss can be set above the MYR2,036 mark, the high of 13 Nov.

Immediate support is pegged at MYR1,863, the low of 25 Aug 2015. The second support is at MYR1,800. Towards the upside, immediate resistance is expected at the MYR2,000 psychological level. This is followed by MYR2,100.

Source: RHB Securities Research - 16 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024