FCPO - Bulls Still Lack Strength

rhboskres

Publish date: Mon, 19 Nov 2018, 09:12 AM

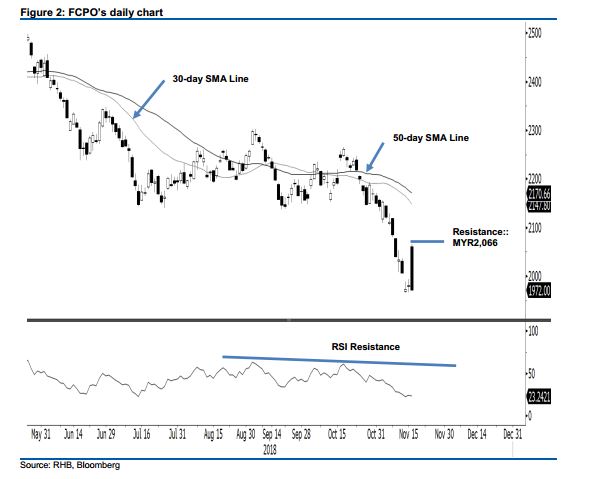

Maintain short positions as upside is still capped. The FCPO formed a black candle last Friday, as it failed to sustain the positive momentum seen early in the session. The intraday tone was negative, as the commodity generally slid lower from a high of MYR2,066 to a low of MYR1,969, before ending at MYR1,972 – indicating a decline of MYR7. The failure of the commodity to maintain its early session’s positive position indicates the overall negative tone is still bearish – even though the daily RSI reading is now located at the oversold level of 23.24. Lending further support to this negative interpretation is the fact that both the 30-day and 50-day SMA lines are continuing to edge lower. Hence, we keep to our negative trading bias.

As the bears are still in clear control over the price trend, we still recommend that traders keep to short positions. We initiated these at MYR2,148, or the closing level of 26 Oct. To manage risks, a stop-loss can be set above the MYR2,066, the latest session’s high.

Immediate support remains at MYR1,863, the low of 25 Aug 2015. This is followed by MYR1,800. Towards the upside, immediate resistance is expected at the MYR2,000 psychological level. This is followed by MYR2,066, the latest session’s high.

Source: RHB Securities Research - 19 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024