E-mini Dow Futures - Short Positions Triggered

rhboskres

Publish date: Wed, 21 Nov 2018, 04:29 PM

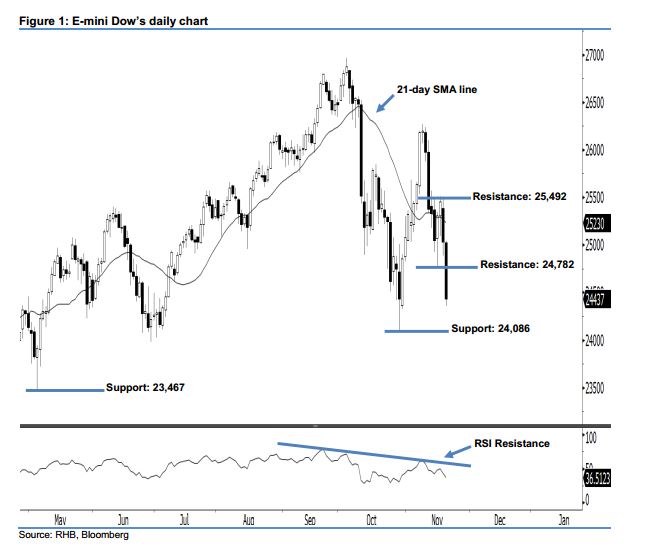

Initiate short positions below the 24,782-pt level. The E-mini Dow formed a long black candle last night. It plunged 592 pts to close at 24,437 pts, off the session’s high of 25,042 pts. On a technical basis, the index has formed a second consecutive black candle and marked a lower close below the 21-day SMA line, which indicates that market sentiment is turning bearish. In addition, the 14-day RSI turned lower for a weaker reading at 36.51 pts as of last night, thereby enhancing the bearish sentiment. Meanwhile, 13 Nov’s closing triggered our previous trailing-stop recommendation at the 25,365-pt threshold – which has locked in part of the profits. Note we initially advised traders to initiate long above the 24,823-pt level on 1 Nov.

Currently, we are eyeing the immediate resistance at 24,782 pts, situated near the midpoint of 20 Nov’s long black candle. The next resistance will likely be at 25,492 pts, ie the high of 19 Nov. Towards the downside, we anticipate the near-term support at 24,086 pts, defined from the low of 29 Oct. This is followed by 23,467 pts, which was the previous low of 3 May.

Hence, we advise traders to initiate short positions below the 24,782-pt level. A stop-loss is advisable above the 25,492-pt threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 21 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024