Hang Seng Index Futures - Stick to Long Positions

rhboskres

Publish date: Thu, 22 Nov 2018, 04:28 PM

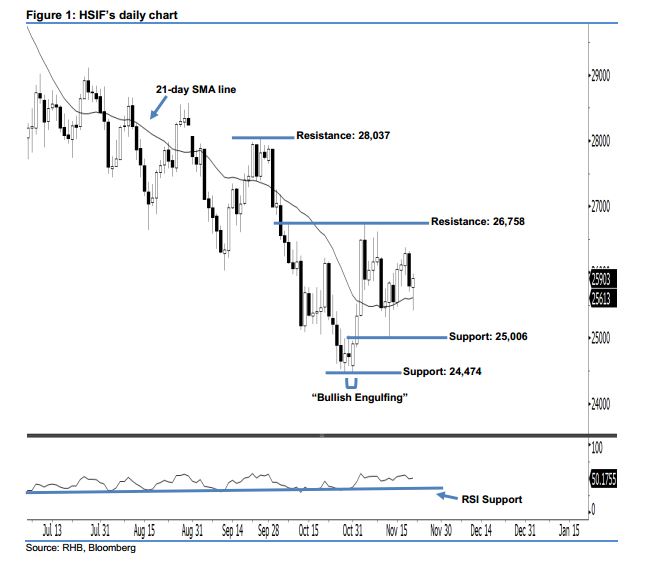

Stay long while setting a stop-loss below the 24,474-pt support. The HSIF formed a positive candle with a long lower shadow yesterday. During the intraday session, it dropped to a low of 25,414 pts before ending at 25,903 pts for the day. Technically speaking, we maintain our bullish view, since the index is still trading above the 25,006-pt and 24,474-pt supports mentioned previously. The long lower shadow indicated there was initial selling momentum before the market recouped the intraday losses by the end of the trading session – reflecting that buyers still had control over the market.

As seen in the chart, we are eyeing the near-term support level at 25,006 pts, which was the low of 13 Nov. This is followed by 24,474 pts, obtained from the previous low of 31 Oct’s “Bullish Engulfing” pattern. Towards the upside, the immediate resistance level is maintained at 26,758 pts, ie the high of 5 Nov. Meanwhile, the next resistance would likely be at 28,037 pts, defined from the previous high of 26 Sep.

Hence, we advise traders to stay long, given that we initially recommended initiating long above the 25,900-pt level on 5 Nov. A stop-loss can be set below the 24,474-pt threshold in order to minimise downside risk.

Source: RHB Securities Research - 22 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024