WTI Crude Futures - A Minor Bounce

rhboskres

Publish date: Thu, 22 Nov 2018, 04:29 PM

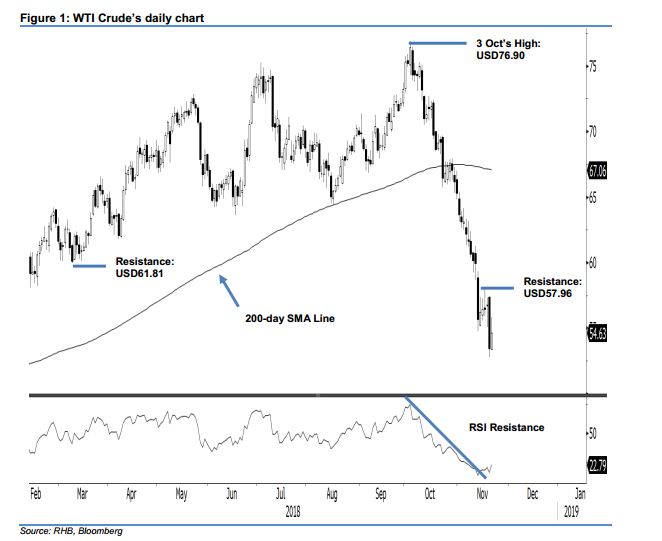

No strong signs of a deeper rebound yet; maintain short positions. The WTI Crude ended the latest session on a positive note. It settled USD1.20 higher at USD54.63 – after oscillating between a low and high of USD53.39 and USD55.86. The positive session was not sufficient to produce firm technical evidence that a deeper rebound is on the cards – further positive follow-through in the coming sessions is needed. This is despite the daily RSI reading still indicating an oversold position. For now, towards the upside, prospects for a deeper rebound may only emerge should the immediate resistance of USD57.96 be recaptured. Until this happens, we maintain our negative trading bias.

In the absence of a clear deeper price rebound signal – we continue to recommend traders keep to short positions. We initiated short positions at USD70.97, which was the closing of 11 Oct. For risk management purposes, a stop-loss can be placed above the USD57.96 mark.

Immediate support is kept at USD50, a round figure. The following support is at USD45.58, which was the low of 31 Aug 2017. Moving up, immediate resistance is now expected at USD57.96, the high of 16 Nov. This is followed by USD61.81, the low of 6 Apr.

Source: RHB Securities Research - 22 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024