WTI Crude Futures - the Bears Are Relentless

rhboskres

Publish date: Mon, 26 Nov 2018, 10:13 AM

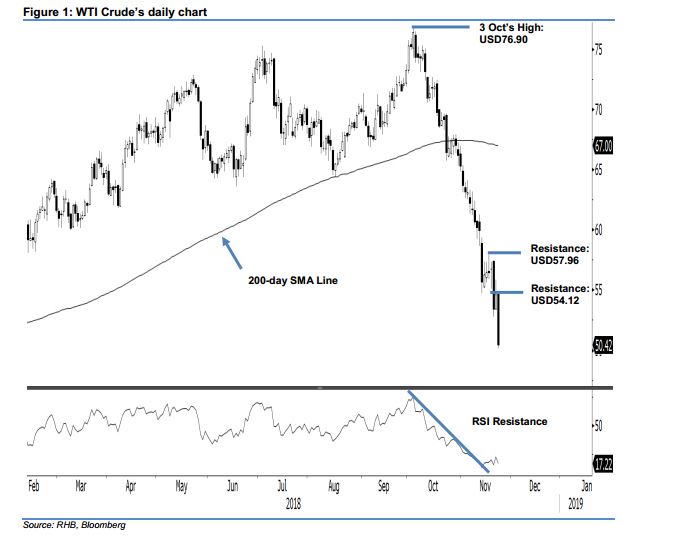

Maintain short positions, as the declining trend is being stretched. The WTI Crude formed a black candle in the latest session and, at one point, came near to testing the USD50 support. The intraday tone was negative – the commodity generally trended lower for the entire session, with the high and low posted at USD54.12 and USD50.15. It closed at USD50.42, indicating a decline of USD4.21. The weak session continues to suggest the weak price trend – since the high of USD76.90 on 3 Oct – is still extending. This is despite the daily RSI reading signalling an oversold position. Until we see clear price actions to suggest an end to the current bout of weak price trend, we maintain our negative trading bias.

Given that the negative price trend is not showing any signs of ending, we continue to recommend traders to keep short positions. We initiated short positions at USD70.97, which was 11 Oct’s close. For risk-management purposes, a stop-loss can now be placed above the USD54.12 mark.

Towards the downside, the immediate support is set at USD50, a round figure. The second support is at USD45.58, which was the low of 31 Aug 2017. Conversely, immediate resistance is now pegged at USD54.12, the latest session’s high. This is followed by USD57.96, or the high of 16 Nov.

Source: RHB Securities Research - 26 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024