FCPO - Raising The Trailing Stop

rhboskres

Publish date: Thu, 22 Nov 2018, 04:31 PM

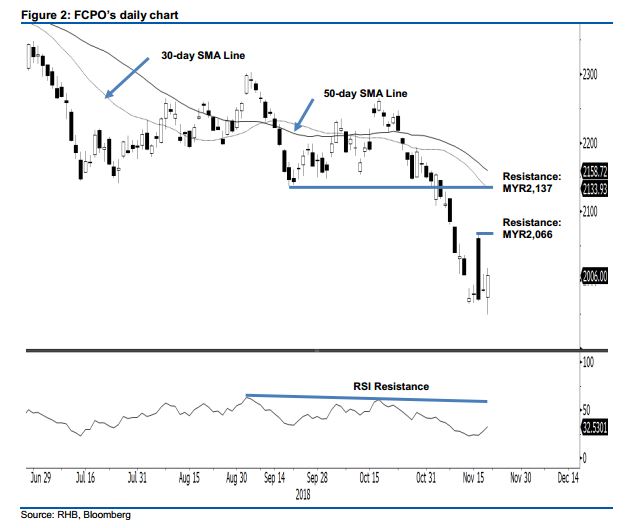

Maintain short positions while tightening up trailing-stop. The FCPO formed a white candle in the latest trading – it managed to reverse the early session’s losses. Intraday, the tone was positive as the commodity generally scaled higher, with the low and high recorded at MYR1,949 and MYR2,017 before ending at MYR2,006, implying a gain of MYR20. The intraday sharp reversal may be an initial indication that the commodity’s steep retracement could be reaching an end. This is further supported by the fact its daily RSI reached the oversold threshold recently. Should the commodity breach above the latest session’s high, there is a strong chance it may be able to pose a deeper rebound. However, until this happens, we keep to our negative trading bias.

Pending confirmation of a deeper rebound, we continue to recommend traders to keep to short positions. We initiated these at MYR2,148, or the closing level of 26 Oct. To manage risks, a stop-loss can now be set at above the MYR2,017 mark, the latest session’s high.

The immediate support is still pegged at MYR1,863, the low of 25 Aug 2015. The following support is at MYR1,800. Conversely, the immediate resistance is revised to MYR2,066, the high of 16 Nov. This is followed by MYR2,137, the low of 20 Sep.

Source: RHB Securities Research - 22 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024