WTI Crude Futures - Awaiting Stronger Rebound Signs

rhboskres

Publish date: Tue, 27 Nov 2018, 10:05 AM

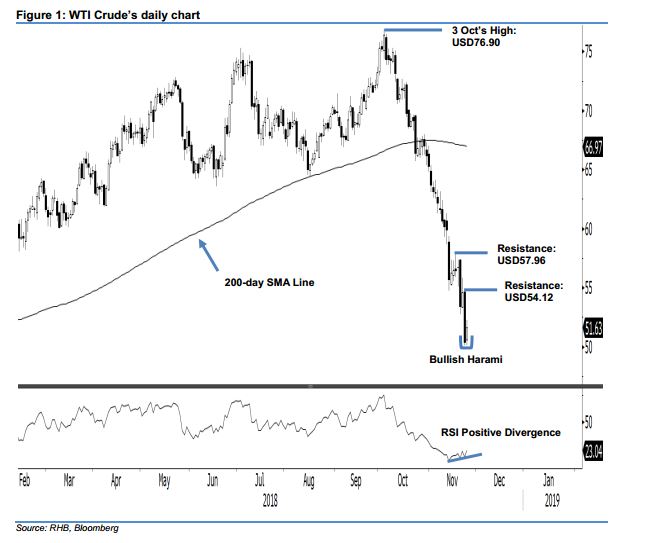

Maintain short positions pending signals for a deeper rebound. The WTI Crude closed the latest session on a positive note, consequently a “Bullish Harami” formation appeared. The session’s low and high were posed at USD50.10 and USD52.25, before it ceased USD1.21 higher at USD51.63. The appearance of the said positive candlestick formation came after the commodity’s recent weeks’ sharp retracement saw its daily RSI fall into oversold threshold. We also note that the past few sessions’ weak price performance came with the positive divergence in the RSI reading. However, until a clearer price signal emerges to suggest a deeper rebound, we are keeping our negative trading bias for now.

Until the bulls show greater strength to end the commodity’s multi-week negative price trend, we continue to recommend traders to keep short positions. We initiated short positions at USD70.97, which was 11 Oct’s close. For risk-management purposes, a stop-loss can be placed above the USD54.12 mark.

Immediate support is expected to emerge at USD50, a round figure. The following support is at USD45.58, which was the low of 31 Aug 2017. Moving up, immediate resistance is at USD54.12, the latest session’s high. This is followed by USD57.96, or the high of 16 Nov.

Source: RHB Securities Research - 27 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024