COMEX Gold - Consolidation Mode Still Developing

rhboskres

Publish date: Tue, 27 Nov 2018, 10:06 AM

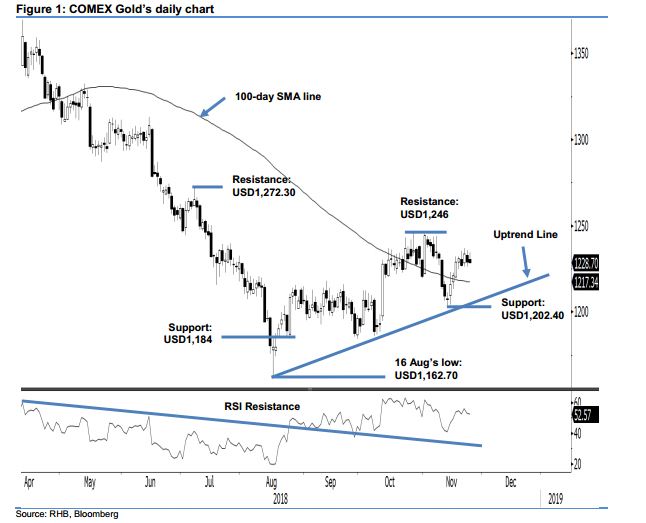

Maintain long positions, as the overall upward bias is still in place. The COMEX Gold ended the latest trading session slightly on the negative, it closed USD0.40 lower to settle at USD1,228.70. The trading range was between USD1,228 and USD1,234.50. The negative move can be seen as part of the commodity’s ongoing consolidation phase, which has been developing over the past few sessions – this means we are not seeing signs that the rebound is ending. Provided the commodity stays within the uptrend line (as drawn in the chart), the possibility is high for it to extend its upward price trajectory. On these, we maintain our positive trading bias.

As the commodity is likely to resume its positive price trend once the ongoing consolidation phase is finished, we continue to recommend that traders keep to long positions at USD1,216. This was 14 Nov’s closing level. For risk-management purposes, a stop-loss can be placed at the USD1,202.40 mark.

Immediate support is still pegged at USD1,202.40, or the low of 13 Nov. The second support is at USD1,184, which was the low of 24 Aug. Conversely, the immediate resistance is set at USD1,246, ie the high of 26 Oct. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 27 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024