FKLI - Bulls Not Letting Go

rhboskres

Publish date: Tue, 27 Nov 2018, 10:11 AM

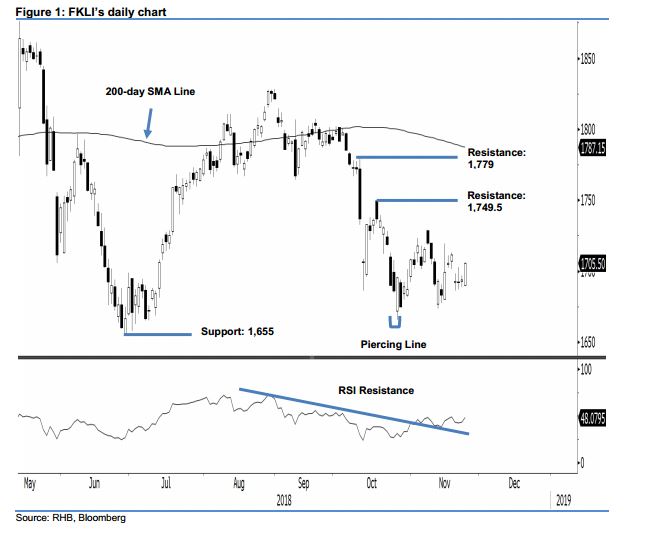

Maintain long positions, as the bias for rebound is still in place. Yesterday, the FKLI reversed its early session’s losses to form a white candle, indicating a possible re-emergence of the bulls. The index generally trended higher throughout the session with the low and high posted at 1,689.5 pts and 1,706 pts, before ending at 1,705.5 pts – a 11.5-pt gain. The session’s relatively strong performance suggests that the index’s directionless trend over the past week may have reached its end. As such, chances are high that it may now resume its deeper rebound phase, which started from the low of the “Piercing Line” formation on 25 Oct. Towards the upside, we are expecting the bulls to test the immediate resistance of 1,749.5 pts. Hence, we maintain our positive trading bias.

As chances are high for the rebound phase to restart, we continue to recommend that traders stay in long positions – which we initiated at 1,718 pts, or 2 Nov’s closing level. For risk management purposes, a stop-loss can be placed at 1,655 pts.

The immediate support is maintained at the 1,655-pt level, the low of 28 June. This is followed by 1,600-pt mark. Moving up, the immediate resistance is now expected at 1,749.5 pts, or the high of 17 Oct. This is followed by 1,779 pts, the high of 10 Oct.

Source: RHB Securities Research - 27 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024