FCPO - Bears Attempt To Test The Rebound Phase

rhboskres

Publish date: Tue, 27 Nov 2018, 10:12 AM

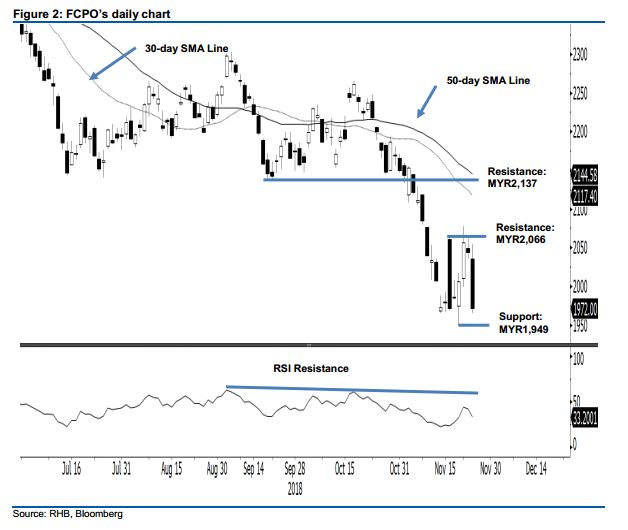

Maintain long positions provided the recent low is not broken. The FCPO ended the latest session negatively. Intraday, the commodity generally moved lower the entire session – the high and low were recorded at MYR2,055 and MYR1,973, before closing at MYR1,972, implying a relatively steep decline of MYR72. The sharp reversal came after the commodity experienced a steep rebound in the prior week. Nevertheless, chances are still strong for the commodity to extend its rebound phase, provided the recent low of MYR1,949 is not breached, Recalled that the rebound phase was triggered after the commodity experienced a steep retracement between mid-October to mid-November, which saw its daily RSI reaching the oversold threshold. Hence, we maintain our positive trading bias.

As the negative session has not negated the overall bias for the commodity to rebound further, we continue to recommend that traders maintain their long positions. We initiated these positions at MYR2,057, or the closing level of 22 Nov. A stop-loss can be placed at below MYR1,949.

Towards the downside, the immediate support is at MYR1,949, the low of 21 Nov. This is followed by MYR1,863, the low of 25 Aug 2015. Towards the upside, the immediate resistance remains at MYR2,066, the high of 16 Nov. This is followed by MYR2,137, the low of 20 Sep.

Source: RHB Securities Research - 27 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024