FCPO - Testing YTD Low

rhboskres

Publish date: Wed, 28 Nov 2018, 04:59 PM

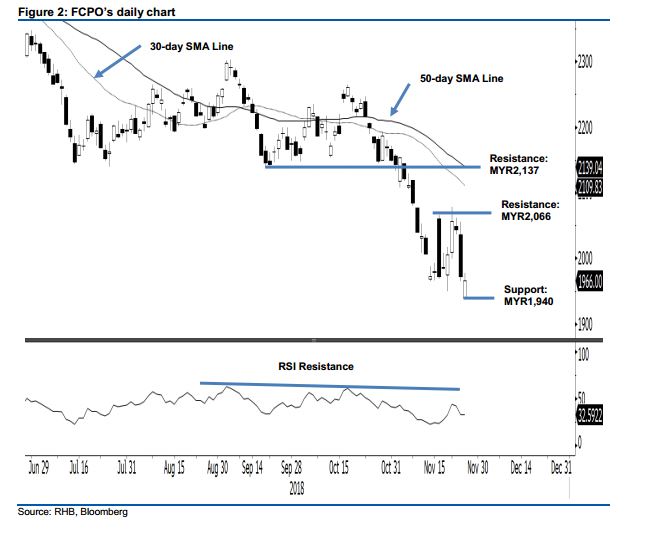

Maintain long positions. Yesterday, the FCPO tested the previous support of MYR1,949 and formed a white candle as it reversed most of its early session’s losses to end MYR6 lower, at MYR1,966. The commodity generally scaled higher after a weak opening, while the low and high were at MYR1,940 and MYR1,977. The ability of the commodity to rebound from the said previous support mark indicates that the bulls may re-emerge. We maintain the view that the commodity is due for a rebound after its steep retracement between mid-October to mid-November sent its daily RSI into oversold territory. Hence, we maintain our positive trading bias.

As the FCPO’s rebound is still likely to develop, traders should remain in long positions. We initiated these positions at MYR2,057, or the closing level of 22 Nov. A stop-loss can now be placed below MYR1,940.

Immediate support is revised to MYR1,940, the latest session’s low. The second support is at MYR1,863, the low of 25 Aug 2015. On the other hand, the immediate resistance remains at MYR2,066, the high of 16 Nov. This is followed by MYR2,137, the low of 20 Sep.

Source: RHB Securities Research - 28 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024