COMEX Gold - Bulls Are Dominating

rhboskres

Publish date: Fri, 30 Nov 2018, 05:16 PM

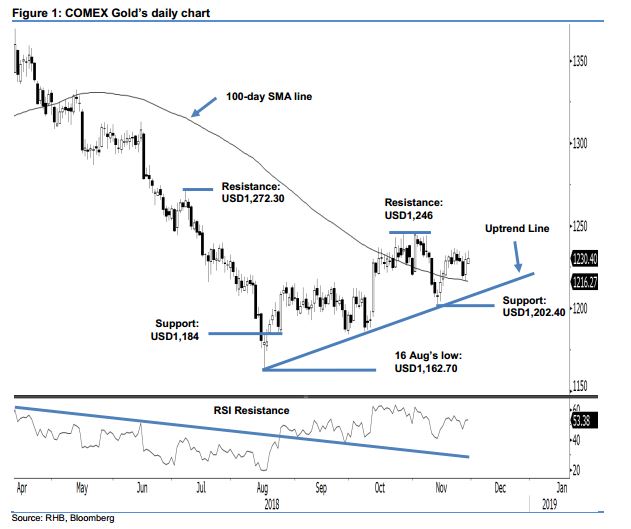

Maintain long positions to ride on the uptrend. The COMEX Gold ended the latest session slightly higher, by USD0.60, to settle at USD1,230.40. This was after it swung between a low and high of USD1,226.70 and USD1,234.90. The latest performance can be seen as the continuation form the previous session’s strong rebound from the 100-day SMA line. Provided both the said SMA line and the uptrend line (drawn in the chart) are not breached to the downside, the commodity’s upward move since the low of USD1,162.70 would not be at the risk of reversing. Hence, we are maintaining our positive trading bias.

As chances are high that the commodity would, as a trend, still be able to scale higher, we continue to recommend that traders keep to long positions at the USD1,216 mark. This was 14 Nov’s closing level. For riskmanagement purposes, a stop-loss can be placed at the USD1,202.40 threshold.

Towards the downside, immediate support is set at USD1,202.40, or the low of 13 Nov. This is followed by USD1,184, which was the low of 24 Aug. Moving up, the immediate resistance is set at USD1,246, ie the high of 26 Oct. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 30 Nov 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024