COMEX Gold - Uptrend Still Valid

rhboskres

Publish date: Mon, 03 Dec 2018, 09:31 AM

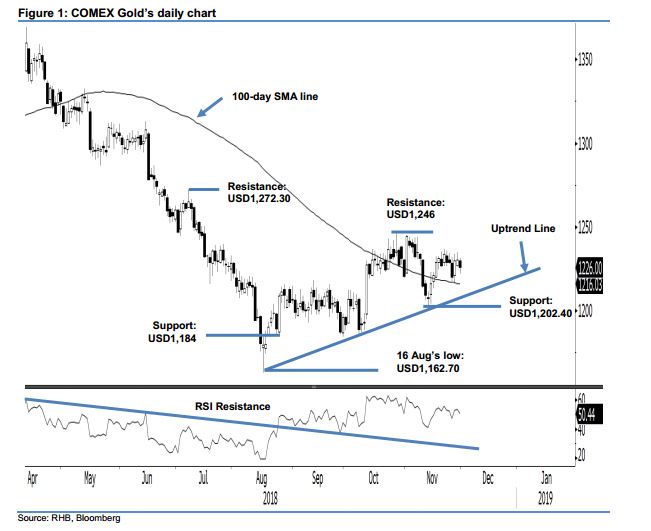

Maintain long positions, as the trend remains positive. The COMEX Gold ended the last Friday’s session negatively. It closed USD4.40 lower to settle at USD1,226 after having posted a low and high of USD1,221.80 and USD1,231.10. The negative session can see seen as a possible sign that the bulls are taking a breather after a relatively strong rebound from the 100-day SMA line in the prior two sessions. Provided the commodity continues to move above both the said SMA and uptrend lines (as drawn in the chart), chances are high that its uptrend – which started from the low of USD1,162.70 on 16 Aug – should be extended. Consequently, we maintain our positive trading bias.

As the latest weak session is treated as a possible sign of a minor consolidation and – in the absence of signals suggesting the uptrend is reaching an end – we continue to recommend traders to keep to long positions at the USD1,216 mark, or 14 Nov’s closing level. For risk-management purposes, a stop-loss can be placed at the USD1,202.40 threshold.

We still peg the immediate support at USD1,202.40, or the low of 13 Nov. The second support is at USD1,184, which was the low of 24 Aug. Conversely, the immediate resistance is set at USD1,246, ie the high of 26 Oct. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 3 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024