Hang Seng Index Futures - Upside Move Likely to Continue

rhboskres

Publish date: Mon, 03 Dec 2018, 09:34 AM

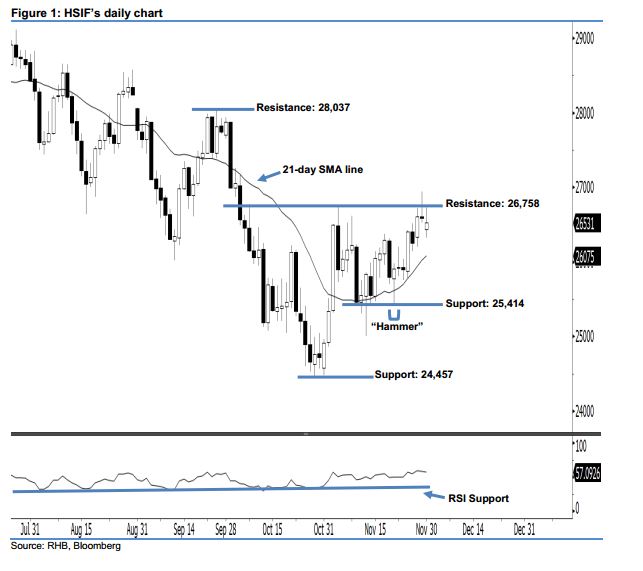

Stay long, with a new trailing-stop set below the 25,414-pt support. The HSIF formed a white candle last Friday. It settled at 26,531 pts after having oscillated between a high of 26,730 pts and low of 26,321 pts. From a technical perspective, the bullish sentiment stays intact, as the index continues to hold above the rising 21-day SMA line. Moreover, this movement may further extend the upside swing that started with 21 Nov’s “Hammer” pattern. Overall, we expect the market to rise further if the immediate 26,758-pt resistance mentioned previously is taken out decisively in the coming sessions.

Based on daily chart, the immediate support is now anticipated at 25,414 pts, which was determined from the low of 21 Nov’s “Hammer” pattern. If this level is taken out, look to 24,457 pts – ie the previous low of 29 Oct – as the next support. On the other hand, the immediate resistance is maintained at 26,758 pts, which was the high of 5 Nov. The next resistance is seen at 28,037 pts, or the previous high of 26 Sep.

As a result, we advise traders to maintain long positions – this is in line with our initial recommendation to have long positions above the 25,900-pt level on 5 Nov. For now, a new trailing-stop can be set below the 25,414-pt threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 3 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024