FCPO - Extending The Rebound

rhboskres

Publish date: Mon, 03 Dec 2018, 09:49 AM

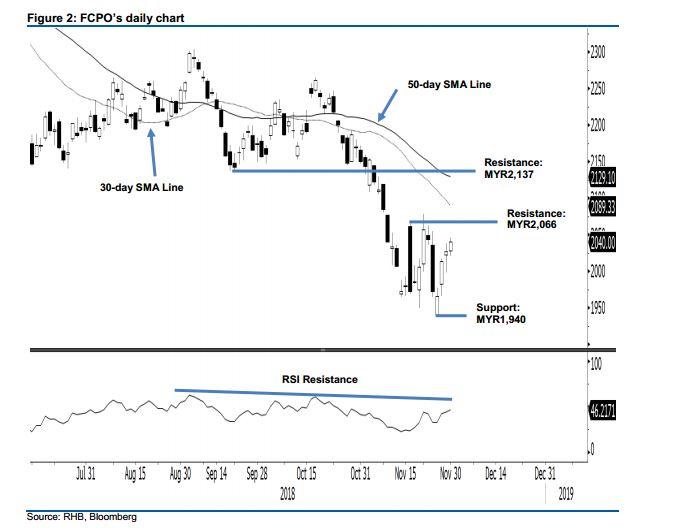

Maintain long positions as bulls are charging ahead. Last Friday, the FCPO closed MYR13 higher, at MYR2,040. The session’s low and high were at MYR2,020 and MYR2,046. The positive session suggests that the rebound phase which started from the low of MYR1,940 is still developing. This ongoing rebound set in after the commodity’s multi-week retracement sent its daily RSI into oversold territory recently. Towards the upside, in the absence of a price exhaustion signal, we continue to expect both the 30-day and 50-day SMA lines to be tested. Hence, we are keeping our positive trading bias.

As the commodity is still in the initial stage of developing a deeper rebound, and both SMA lines are expected to be tested, traders should remain in long positions. We initiated these positions at MYR2,057, or the closing level of 22 Nov. A stop-loss can be placed below MYR1,940.

Towards the downside, immediate support remains at MYR1,940, the low of 27 Nov. This is followed by MYR1,863, the low of 25 Aug 2015. Moving up, the immediate resistance is set at MYR2,066, the high of 16 Nov. This is followed by MYR2,137, the low of 20 Sep.

Source: RHB Securities Research - 3 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024