Hang Seng Index Futures - Rally Continues

rhboskres

Publish date: Tue, 04 Dec 2018, 09:37 AM

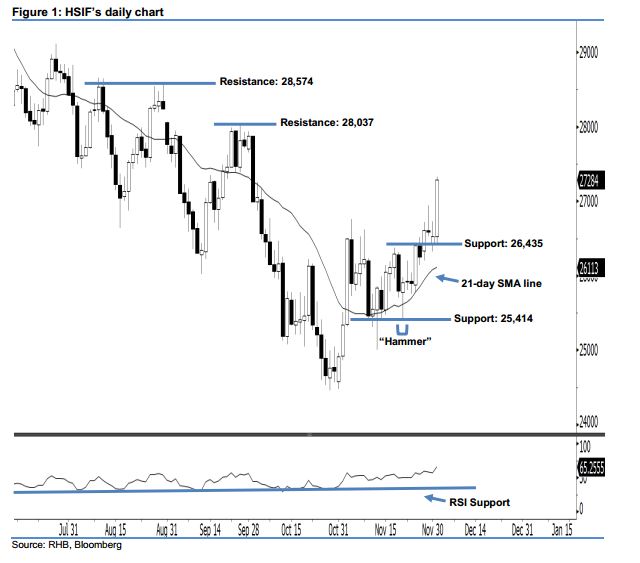

Maintain long positions. The HSIF formed a long white candle yesterday, indicating that momentum of buying could be strong. It surged 753 pts to settle at 27,284 pts, off the session’s low of 26,435 pts. As seen in the chart, the upside move is likely to continue, as the index has taken out the 26,758-pt resistance mentioned previously. Moreover, as the index has continued to stay above the rising 21-day SMA line, this is an indication that the bullish sentiment should remain intact.

Presently, we anticipate the immediate support level at 26,435 pts, which was the low of 3 Dec’s long white candle. If the price breaks down, the next support is maintained at 25,414 pts, obtained from the low of 21 Nov’s “Hammer” pattern. To the upside, the immediate resistance level is seen at 28,037 pts, ie the previous high of 26 Sep. Meanwhile, the next resistance would likely be at 28,574 pts, determined from the high of 30 Aug.

Thus, we advise traders to stay long, since we had originally recommended initiating long above the 25,900-pt level on 5 Nov. In the meantime, a trailing-stop is advisable to set below the 25,414-pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 4 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024