WTI Crude Futures - Hoping for a Deeper Rebound

rhboskres

Publish date: Tue, 04 Dec 2018, 09:40 AM

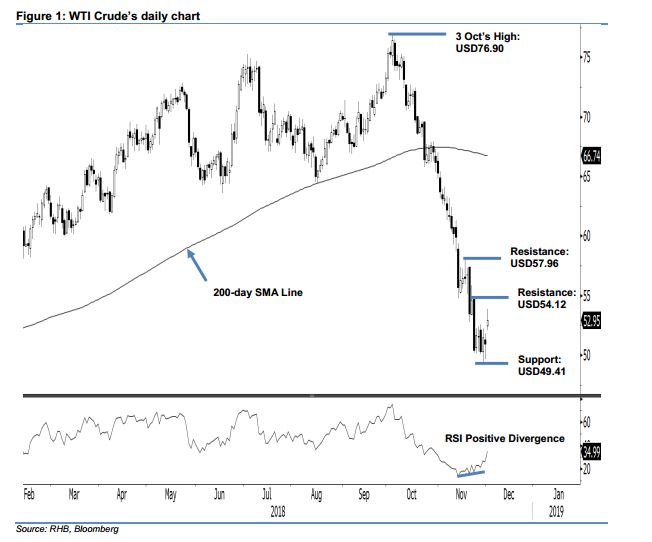

Initiate long positions as the multi-week retracement has reached an end. The WTI Crude formed a white candle in the latest session. At the closing it crossed the previous immediate resistance of USD52.56 – thus fulfilling our required price signal to flag an end to its multi-week steep retracement, which started from the high of USD76.90 on 3 Oct. Session’s low and high were posted at USD52.03 and USD53.85, before it ceased at USD52.95, indicating a gain of USD2.02. The price reversal signal came after the commodity’s steep retracement was stretched, with its daily RSI hitting the oversold threshold while also flashing out positive divergence. Hence, we switch our trading bias to positive.

Our previous short positions that were initiated at the USD70.97 level (11 Oct’s close) were closed out yesterday at USD52.56. As the commodity is now likely developing a rebound, we initiate long positions at the latest closing. For risk management purposes, a stop-loss can be placed at below USD49.41.

We revise the immediate support to USD49.41, the low of 29 Nov. This is followed by the USD45.58 threshold, which was the low of 31 Aug 2017. Conversely, the immediate resistance is now expected at the USD54.12 mark, ie the high of 23 Nov. This is followed by USD57.96, the high of 16 Nov.

Source: RHB Securities Research - 4 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024