FKLI - Positive Bias Still in Place

rhboskres

Publish date: Wed, 05 Dec 2018, 05:07 PM

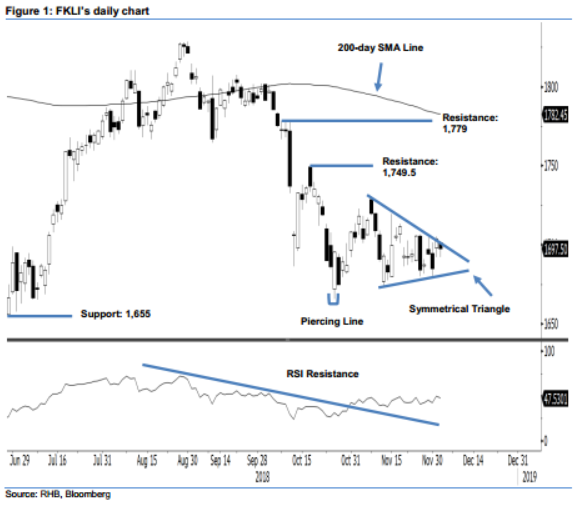

Maintain long positions as the bulls are still lingering around. The FKLI ended yesterday’s trading on the negative. It eased 6.5 pts to settle at 1,697.5 pts – this came after it swung between a low and high of 1,692 pts and 1,702 pts. Nevertheless, the soft session has not negated the index’s overall bullish bias. Instead, we are taking the view that it is consolidating below the upper bound trend line of the Symmetrical Triangle” pattern, before a possible breakout. If a breakout happens in the coming sessions, chances are high that the index could test the immediate resistance of 1,749.5 pts. Hence, we maintain our positive trading bias.

As the bias is positive for the index to break away from the said consolidation pattern, we recommend that traders stay in long positions – which we initiated at 1,718 pts, or 2 Nov’s closing level. To manage risks, a stop-loss can be placed at 1,655 pts.

Towards the downside, the immediate support is set at the 1,655-pt level, the low of 28 June. The second support is at the 1,600-pt mark. Conversely, the immediate resistance is now at 1,749.5 pts, or the high of 17 Oct. This is followed by 1,779 pts, the high of 10 Oct.

Source: RHB Securities Research - 5 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024