COMEX Gold - a Hard Rock to Crack

rhboskres

Publish date: Fri, 07 Dec 2018, 04:21 PM

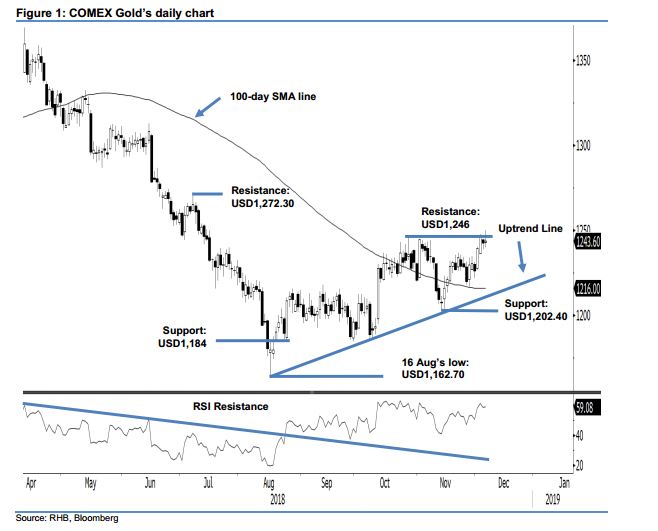

Maintain long positions, as the bulls are still attempting a breakout. The COMEX Gold recorded a marginal gain in the latest session after it attempted to break the USD1,246 immediate resistance. The session’s low and high were posted at USD1,240 and USD1,249.90. The commodity ended at USD1,243.60, indicating a USD1 gain. Including the latest session, the COMEX Gold has been attempting a second breakout from said immediate resistance over the past three sessions – this is necessary in signalling a bias for further upward extension. At this juncture, we have not spotted any price signal that suggests a price rejection or reversal from this level. Consequently, we keep our positive trading bias.

Given that the overall positive price trajectory has not shown signs of exhaustion – despite the failed attempts to breakout so far – we continue to recommend traders keep to long positions at the USD1,216 mark. This was 14 Nov’s closing level. For risk-management purposes, a stop-loss can be placed at the breakeven mark.

Towards the downside, immediate support is expected at USD1,202.40, or the low of 13 Nov. The second support is at USD1,184, which was the low of 24 Aug. Conversely, the immediate resistance is expected at USD1,246, ie the high of 26 Oct. This is followed by USD1,272.30, or the high of 9 Jul.

Source: RHB Securities Research - 7 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024